1-09 End of Day: Grain Markets End Day Mixed Ahead of Tomorrow’s USDA Report

Due to CME settlement issues, prices are last trade prices and not official settlements.

All Prices as of 12:15 pm Central Time

| Corn | ||

| MAR ’25 | 456.75 | 2.75 |

| JUL ’25 | 468.25 | 2.5 |

| DEC ’25 | 446.5 | 1.5 |

| Soybeans | ||

| MAR ’25 | 996.75 | 2.25 |

| JUL ’25 | 1020 | 2 |

| NOV ’25 | 1010 | 1 |

| Chicago Wheat | ||

| MAR ’25 | 532.25 | -4 |

| JUL ’25 | 553.25 | -3.75 |

| JUL ’26 | 608.25 | -8.25 |

| K.C. Wheat | ||

| MAR ’25 | 548 | -2.25 |

| JUL ’25 | 565 | -2.75 |

| JUL ’26 | 611.5 | 0 |

| Mpls Wheat | ||

| MAR ’25 | 582 | -3 |

| JUL ’25 | 599 | -4.25 |

| SEP ’25 | 610 | -3.75 |

| S&P 500 | ||

| MAR ’25 | 5944.75 | -14.5 |

| Crude Oil | ||

| MAR ’25 | 73.52 | 0.85 |

| Gold | ||

| APR ’25 | 2717.9 | 19.6 |

Grain Market Highlights

- Corn prices closed higher today as traders position themselves ahead of tomorrow’s USDA WASDE and Quarterly Grain Stocks reports.

- Soybeans closed higher, receiving support from soybean oil, which ended considerably higher. However, soybean meal posted losses as weather conditions in Argentina improve.

- Wheat futures ended the day lower across all three classes, with the U.S. dollar staying at elevated levels, continuing to keep pressure on the wheat market.

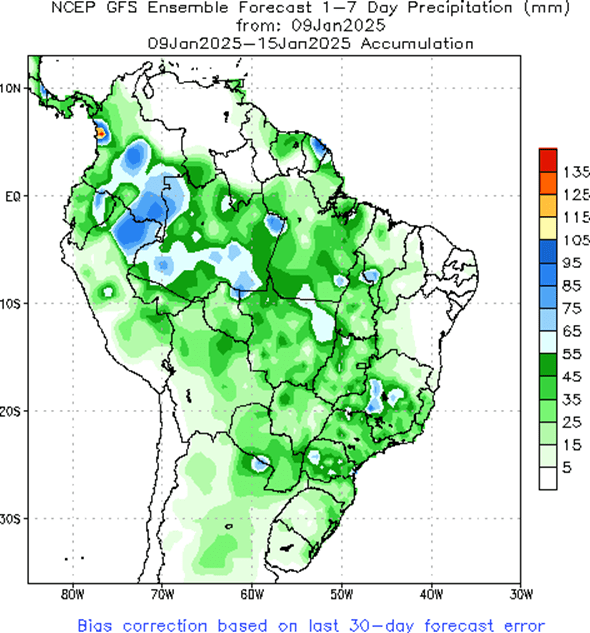

- To see the U.S. 7-day precipitation forecast as well as the Brazil and N. Argentina one-week forecast total precipitation courtesy of the National Weather Service, Climate Prediction Center and NOAA scroll down to the other Charts/Wheat section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

Corn Action Plan Summary

2024 Crop:

- Grain Market Insider recently recommended selling a portion of your 2024 corn crop.

- With March futures knocking on the door of their highest level since June and continuous corn up roughly 23% from the pre-harvest low in August it is time to reward this rally.

- The January WASDE report will be released on Friday, January 10, and it’s one of the most volatile report days of the year. Corn prices often fluctuate by ±4%, depending on whether the report delivers a bullish or bearish surprise. This provides yet another reason to take advantage of the rally, just in case the USDA delivers a bearish shock.

2025 Crop:

- Target 455 – 475 versus Dec ‘25 area to make additional sales against your 2025 crop.

- The strong demand tone for U.S. corn continues to provide support to the market, but this higher price will likely buy additional planted acres in the U.S. for 2025.

- Major resistance on the December 2025 chart is near the 480 futures level. A close above this level could signal a potential breakout from the current range.

- Watch for a recommendation to purchase call options if prices close above major resistance. This strategy would help protect current sales in the event of a prolonged rally.

2026 Crop:

- Patience is advised. No sales recommendations are planned currently, as we continue to monitor the market for more favorable conditions.

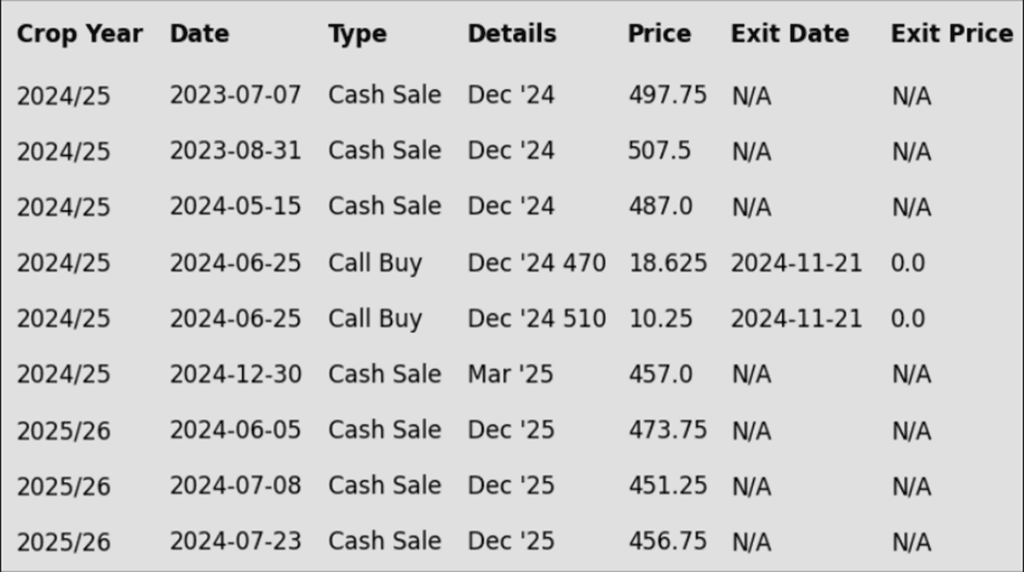

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

- The corn market closed higher for the session as traders anticipated the release of Friday’s USDA WASDE and Quarterly Grain Stocks reports.

- This morning, the Biden Administration issued short-term guidance on the 45Z tax credit plan concerning the clean energy fuel tax credit. The release helped support the market during the session and was much anticipated by the sustainable aviation fuel industry. This was only interim guidance, leaving the final plan up to the Trump Administration.

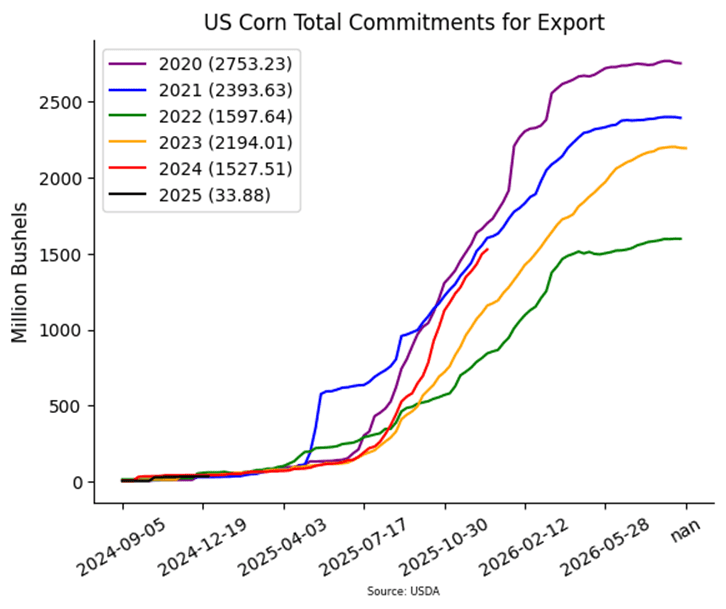

- USDA will release weekly export sales for corn on Friday morning. The market will be watching those totals to gauge the demand pace. Concerns that corn demand may be slowing with higher prices and strong U.S. dollar limiting the U.S. in competitive balance with other global exporters. Expectations for new sales to range from 700,000 – 1.4 MMT for the week ending January 2. Last week’s sales were disappointing at 776,000 MT.

- The expectations for the January WASDE reports are for corn production to be limited, reducing the possible carry out total to 1.680 billion bushels. This may be achieved by a possible lower yield, following the trend from the December report. Grain stock may be a sleeper number on the day with expected stocks at 12.166 billion bushels, just slightly under last year.

Above: The uptrend in the corn market remains intact. Initial support below the market lies near 450, with additional support near 434. Initial overhead resistance comes in near 460 with additional resistance near 475.

Soybeans

Action Plan: Soybeans

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

Soybeans Action Plan Summary

2024 Crop:

- We remain focused on the 1060–1080 range versus March ’25 for recommending additional sales of your 2024 crop.

- Key reasons for targeting this higher range include:

- Funds holding significant short positions across the soy complex—soybeans, meal, and oil.

- The entire soy complex is macro-oversold, a condition that historically favors buying over selling.

- Seasonal opportunities may improve as the South American growing season progresses.

2025 Crop:

- The target range for issuing the first sales recommendation is 1070–1100 versus Nov ’25.

- Keep an eye out for a potential call option recommendation. Since major resistance lies within this range, it’s possible that both a sales recommendation and a call option recommendation could be issued around the same time.

2026 Crop:

- Patience is recommended. No sales recommendations are planned until at least the peak of the U.S. growing season.

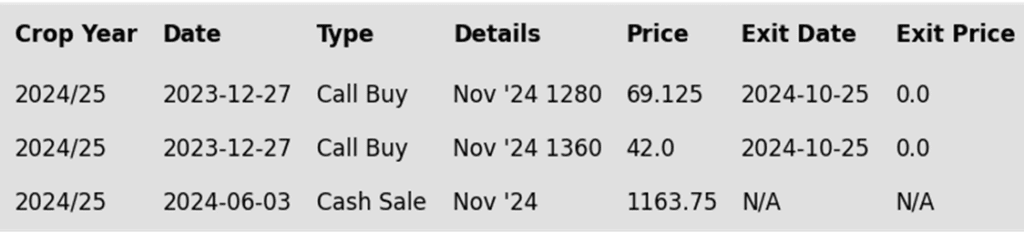

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

- Soybeans ended the shortened trading day higher, supported by a significant gain in soybean oil, while soybean meal traded lower. March soybean meal fell below $300 as weather conditions in Argentina improved, while soybean oil rose in tandem with crude oil.

- In Brazil, the state of Mato Grosso has begun its soybean harvest after dry weather caused planting delays at the beginning of the season. Mato Grosso increased its planted soybean acreage by 1.47% from last year this season.

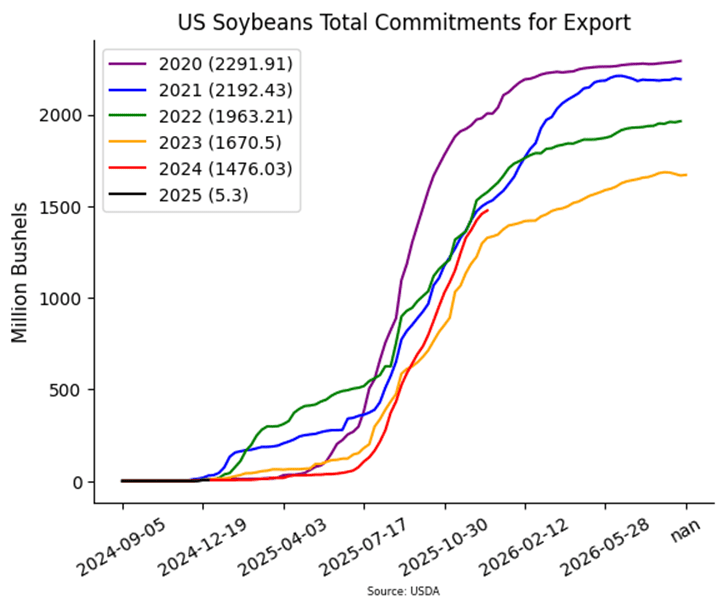

- Pre-report estimates for soybeans in Friday’s WASDE see ending stocks falling by 12 mb to 458 mb. Yield is expected to be reduced by 0.1 bpa to 51.6 bpa, but the bearish surprise in Friday’s report could come from changes made to Brazilian production. Many analysts are expecting soybean production to be above 175 mmt, but the USDA’s last estimate in December was 169 mmt.

- Brazilian soybean exports are expected to be down 30% at 1.71 mmt for the month of January compared to last year at this time. Despite this, a potential record harvest for the country would likely point to record export sales in 2025.

Above: The recent break in prices found initial support near 950. Initial overhead resistance lies just above the market near 1030 with additional resistance between 1060 and 1075.

Wheat

Market Notes: Wheat

- Despite corn and soybeans inching their way to positive closes, wheat was unable to follow suit, with all three classes posting losses. A mixed to lower close for Matif wheat provided no support, and with the U.S. dollar remaining elevated, wheat continues to hover near contract lows.

- With the monthly WASDE data set for release tomorrow, alongside the Winter Wheat Seedings report, the market may see news that could break prices out of their current sideways trend. However, traders are likely to focus more on the USDA’s stance regarding Russian production and exports.

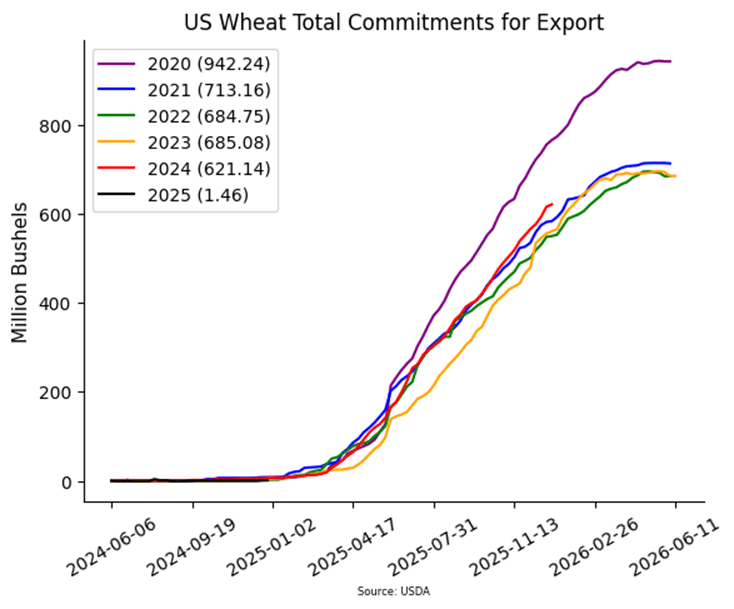

- On a bullish note, U.S. SRW wheat is reported to be priced equally to Argentina’s wheat on a FOB basis and is offered at a $10 per mt discount compared to French wheat. This could support export sales, which are already strong.

- The CME is set to launch a new wheat contract for futures and options trading; if approved, the spring wheat contract will be available in the second quarter. Additionally, the CME will delist the current MIAX/MGEX spring wheat contract from its trading platform.

- India’s wheat production estimate for 2025/26 remains unchanged at 112.7 mmt, according to LSEG. This is despite a larger planted area in Haryana, a key wheat-producing state. While India is a major wheat grower, it consumes nearly all of its production. As a result, any decline in output could force the country to import wheat.

Action Plan: Chicago Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

Chicago Wheat Action Plan Summary

2024 Crop:

- Target 680 – 705 vs March ‘25 to make the next sale.

- For those holding open July ’25 860 and 1020 call options that were recommended in May, target a selling price of about 73 cents for the 860 calls to offset the cost of the remaining 1020 calls. Holding the 1020 calls will provide protection for existing sales and give you confidence to make additional sales at higher prices.

2025 Crop:

- Grain Market Insider recently recommended liquidating a portion of previously recommended put options.

- Continue holding the remaining quarter of the previously recommended July ’25 Chi wheat 620 puts to provide downside protection for unsold bushels. Additionally, target the upper 400 range versus July ’25 Chi wheat to exit these remaining puts if the market makes new lows.

- Patience is advised regarding sales, as we monitor the market for improved conditions and timing.

2026 Crop:

- Patience is advised, as we monitor the market for improved conditions and timing. It may be some time before target ranges are set for the 2026 crop.

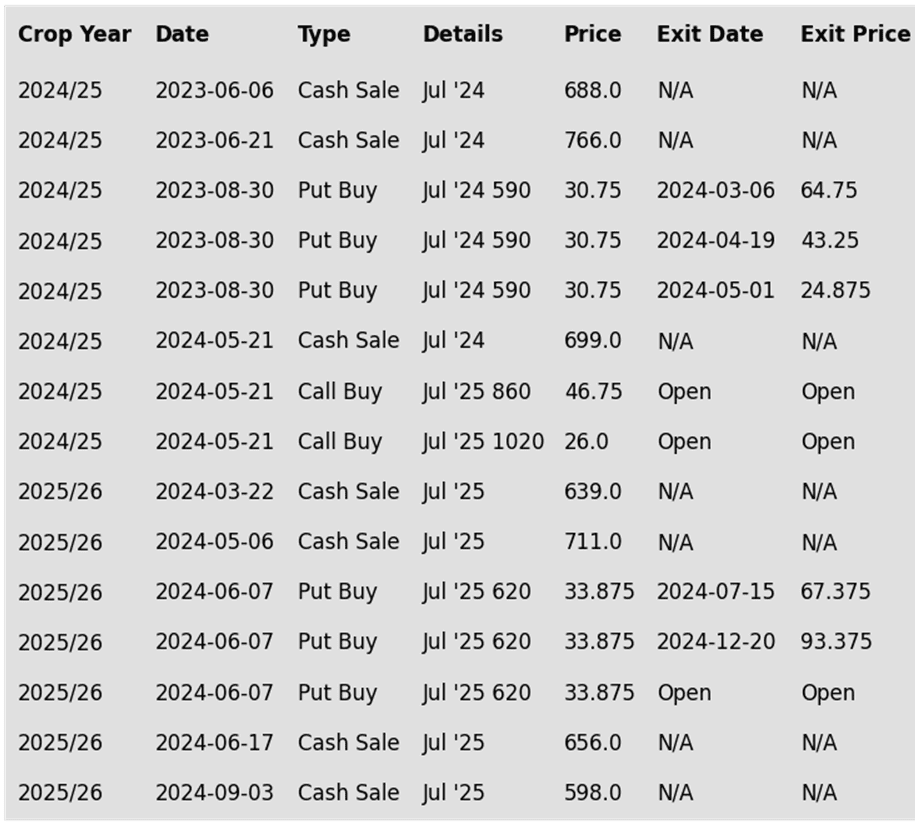

To date, Grain Market Insider has issued the following Chicago wheat recommendations:

Above: Front-month Chicago wheat remains largely rangebound between 540 and 577. A close above the 577–586 resistance area could set up a retest of 617, while a close below 536 might lead to a slide toward the 521–514 support zone.

Action Plan: KC Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

KC Wheat Action Plan Summary

2024 Crop:

- Target the 650 – 700 versus March ‘25 area to sell more of your 2024 HRW wheat crop.

- For those holding the previously recommended July ’25 860 and 1020 calls, target a selling price of about 71 cents on the 860 calls. This would achieve a net-neutral cost on the remaining 1020 calls, and still give you confidence to sell more bushels at higher prices.

2025 Crop:

- Grain Market Insider recently recommended liquidating a portion of previously recommended put options.

- Target the 640 – 665 range versus July ’25 to make additional 2025 HRW wheat sales.

- Continue holding the remaining quarter of the previously recommended July ’25 KC wheat 620 puts to provide downside protection for unsold bushels. Additionally, target the upper 400 range versus July ’25 KC wheat to exit these remaining puts if the market makes new lows.

- If the market rallies considerably, look to protect sales by buying upside calls in the 745 – 770 range versus July ’25. This will also give you confidence to sell more bushels at higher prices.

2026 Crop:

- Patience is recommended. It may be some time before targets are set for the 2026 crop, as we continue to monitor the market for better conditions and timing.

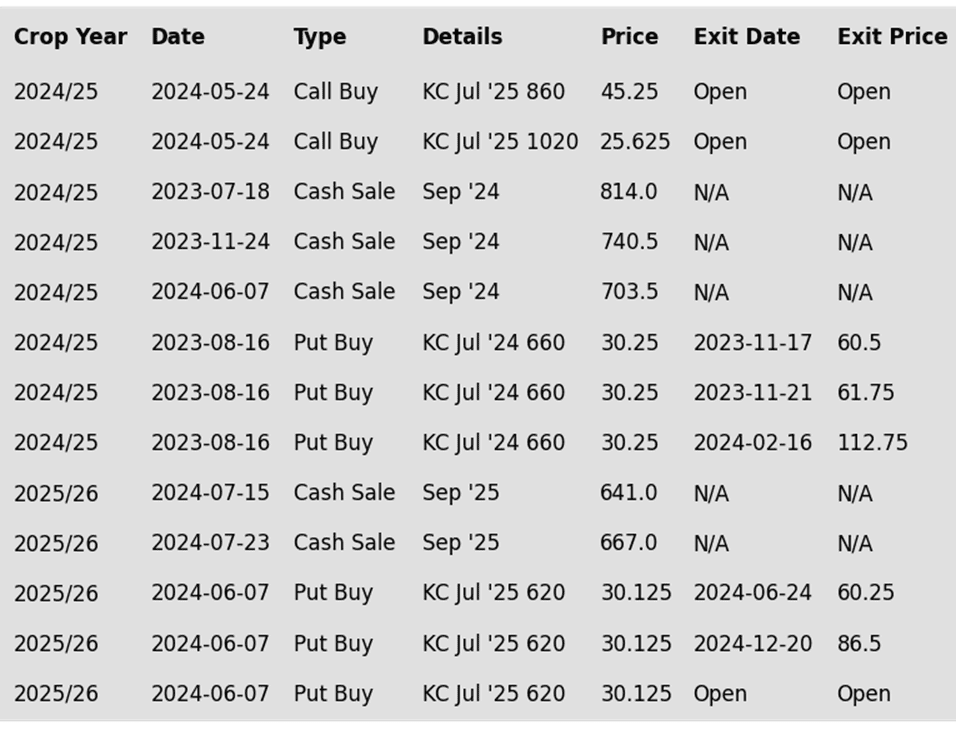

To date, Grain Market Insider has issued the following KC recommendations:

Above: KC wheat remains largely rangebound between 536 and 583, with initial overhead resistance near the 100-day moving average around 568. A close above this level and beyond 583 could set the market up for a test of the 590–595 area, while a close below 536 could put prices at risk of falling to the 525 level.

Action Plan: Mpls Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

Mpls Wheat Action Plan Summary

2024 Crop:

- Potentially targeting a rally to the 610–635 range versus March ’25 for additional sales of your 2024 crop. While this is the initial area of interest, the near-record short position held by the Funds suggests that this target range could shift as future price action develops.

- For those holding the previously recommended July ’25 KC wheat 860 and 1020 calls, target a selling price of approximately 71 cents on the 860 calls. This would achieve a net-neutral cost on the remaining 1020 calls and provide confidence to sell more bushels at higher prices.

2025 Crop:

- Grain Market Insider recently recommended liquidating a portion of previously recommended put options.

- Look to protect existing sales by buying upside calls in the 745 – 770 range versus July ’25 KC wheat if the market turns higher and rallies considerably. This will also give you confidence to sell more bushels at higher prices.

- Continue holding the remaining quarter of the previously recommended July ’25 KC wheat 620 puts to provide downside protection for unsold bushels. Additionally, target the upper 400 range versus July ’25 KC wheat to exit these remaining puts if the market makes new lows.

2026 Crop:

- Patience is recommended. It may be some time before targets are set for the 2026 crop, as we continue to monitor the market for better conditions and timing.

To date, Grain Market Insider has issued the following Minneapolis wheat recommendations:

Above: March Minneapolis wheat is rangebound between 585 and 613. A close above 613 could trigger a rally toward 655, with resistance at 624 and 637. A close below 585 may lead to a decline toward 568.

Other Charts / Weather

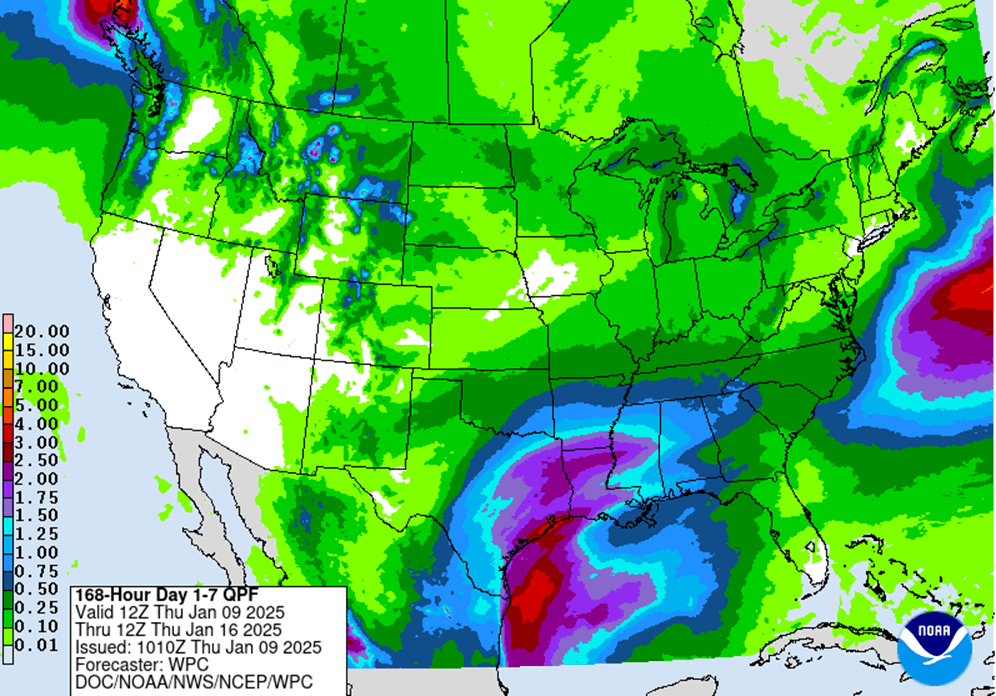

Above: U.S. 7-day precipitation forecast courtesy of NOAA, Weather Prediction Center.

Above: Brazil and N. Argentina one-week forecast total precipitation courtesy of the National Weather Service, Climate Prediction Center.