1-06 End of Day: Lower US Dollar and Argentine Forecast Rallies Grains Monday

All prices as of 2:00 pm Central Time

| Corn | ||

| MAR ’25 | 457.75 | 7 |

| JUL ’25 | 468 | 6.75 |

| DEC ’25 | 445.5 | 4.75 |

| Soybeans | ||

| MAR ’25 | 997.75 | 6 |

| JUL ’25 | 1020.5 | 4 |

| NOV ’25 | 1013 | 4.75 |

| Chicago Wheat | ||

| MAR ’25 | 540.5 | 11.25 |

| JUL ’25 | 561 | 11.75 |

| JUL ’26 | 619.75 | 8.5 |

| K.C. Wheat | ||

| MAR ’25 | 553.25 | 14.25 |

| JUL ’25 | 570 | 13.75 |

| JUL ’26 | 610.75 | 13.25 |

| Mpls Wheat | ||

| MAR ’25 | 592.25 | 14.5 |

| JUL ’25 | 607.75 | 12.75 |

| SEP ’25 | 617.75 | 12.25 |

| S&P 500 | ||

| MAR ’25 | 6021.75 | 32.25 |

| Crude Oil | ||

| MAR ’25 | 72.98 | -0.23 |

| Gold | ||

| APR ’25 | 2670.1 | -9.4 |

Grain Market Highlights

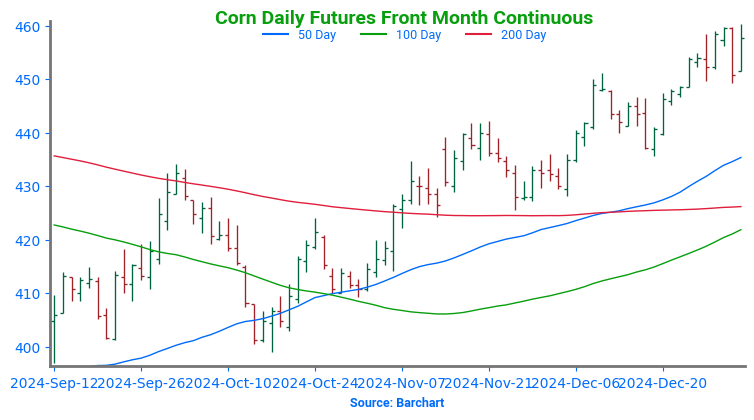

- Corn futures rebounded Monday, supported by a drier Argentine forecast and stronger wheat prices, recovering some of Friday’s losses.

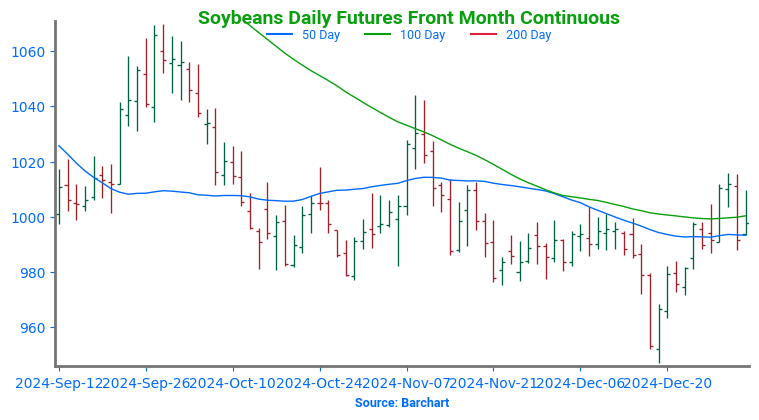

- Soybeans closed higher but off morning highs. Soybean oil posted small gains, while soybean meal ended lower despite the Argentine weather outlook.

- Wheat futures surged, erasing Friday’s losses in KC and Spring wheat. A sharp drop in the U.S. dollar, its weakest daily performance since late November, supported the rally.

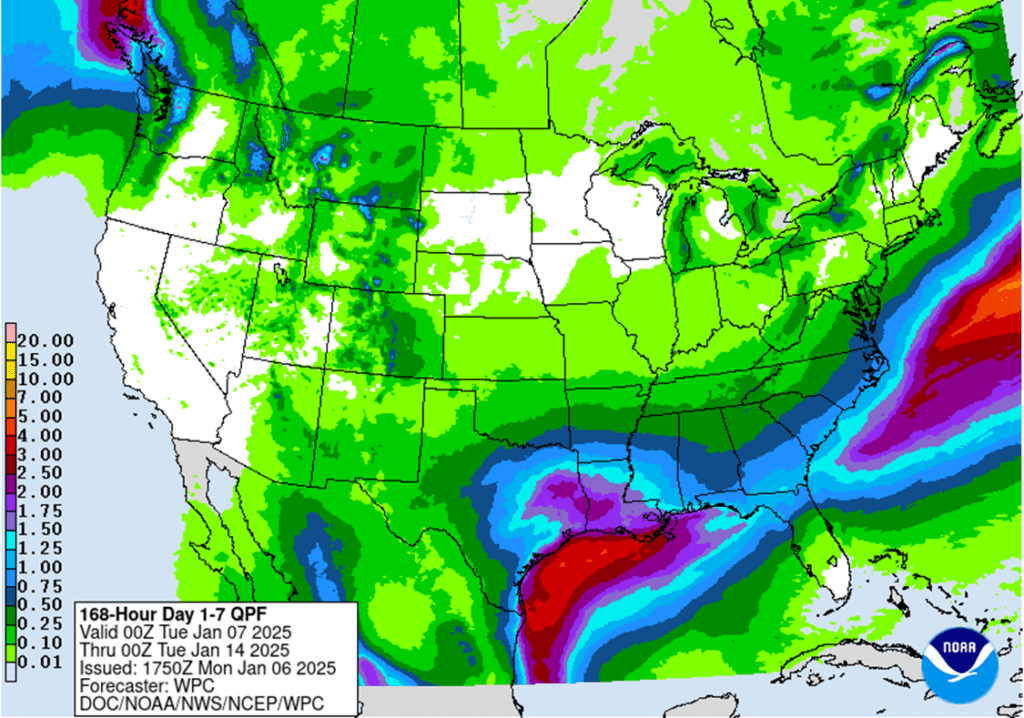

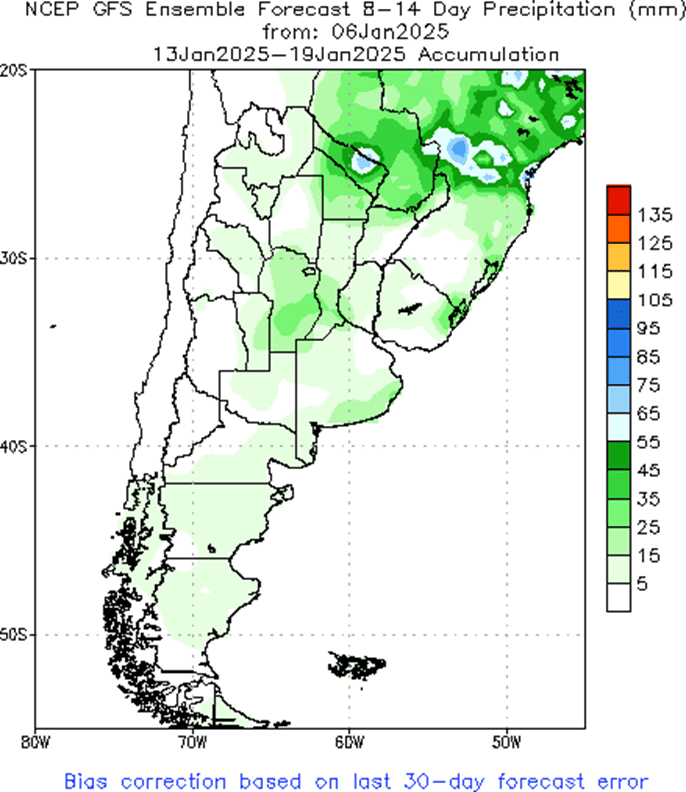

- To see the US 7-day precipitation forecast and the Argentina two-week forecast total precipitation courtesy of the National Weather Service, NOAA and Climate Prediction Center scroll down to the other Charts/Weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

Active

Sell MAR ’25 Cash

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

Corn Action Plan Summary

2024 Crop:

- Grain Market Insider sees a continued opportunity to sell a portion of your 2024 corn crop.

- The March 2024 contract has rallied 30 cents from the Thanksgiving low and has recently traded to its highest level since late June. Looking back even farther, corn is roughly 23% higher than the August low when looking at the continuous corn chart. While strong demand has been a main driver of this rally, we are starting to see corn demand slowing at these higher prices. Therefore, Grain Market Insider sees this as an advantageous area to reward this rally by selling a portion of your 2024 corn crop.

2025 Crop:

- Target the 455 – 460 versus Dec ‘25 area to make additional sales against your 2025 crop.

- The strong demand tone for U.S. corn continues to provide support to the market, but this higher price will likely buy additional planted acres in the US for 2025.

- Major resistance for the December 2025 chart sits near the 480 futures level, a close above this area would be a potential breakout of the current range.

- Be on the lookout for a recommendation to buy call options in the 470–490 range versus Dec ’25 to protect current sales against a potential extended rally.

2026 Crop:

- Patience is advised. No sales recommendations are planned currently, as we continue to monitor the market for more favorable conditions.

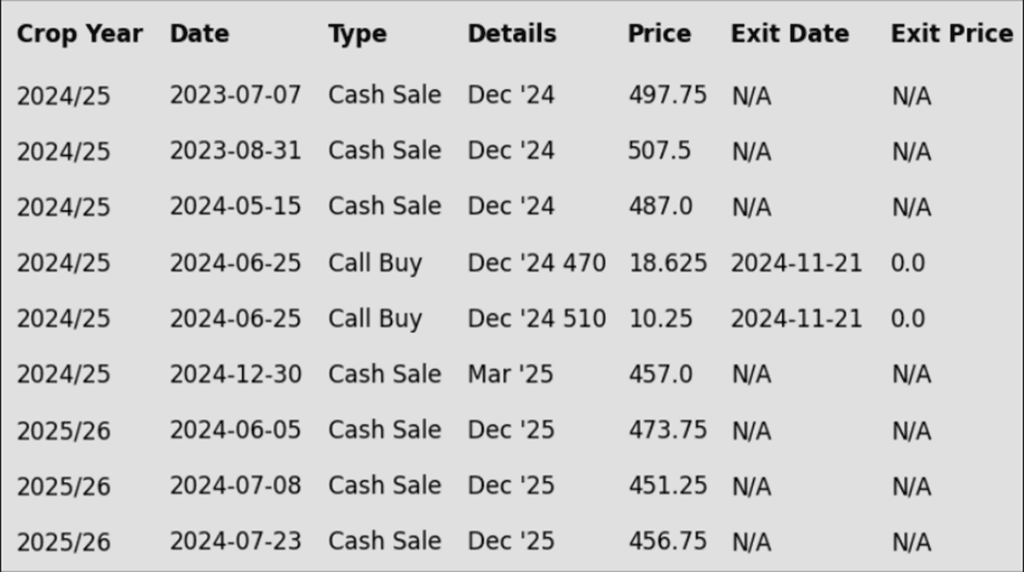

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

- Corn futures rebounded Monday, aided by a weaker U.S. dollar and strong wheat prices. March corn retested $4.60 but failed to hold, ending moderately higher.

- The U.S. Dollar Index fell, driven by a strong Canadian dollar following President Trudeau’s resignation. The weaker dollar supported wheat and spilled over to corn.

- Weekly corn export inspections were very routine in Monday’s report at 847,000 MT (33.6 mb), down slightly from the previous week’s totals. Total inspections for the 2024-25 marketing year are now at 639 mb, up 24% from the previous year.

- Dry and hot weather forecasts for mid-January in Argentina remain a key market focus. Long-range forecasts into late January will likely drive corn and soybean price action.

- The January WASDE and Quarterly Grain Stocks reports on January 10 will be pivotal for stockpile and demand insights, with choppy trading expected ahead of the release.

Above: The uptrend in the corn market remains intact. Initial support below the market lies near 450, with additional support near 434. Initial overhead resistance comes in near 460 with additional resistance near 475.

Soybeans

Action Plan: Soybeans

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

Soybeans Action Plan Summary

2024 Crop:

- We are in the time frame when seasonal opportunities typically improve due to the South American growing season.

- Any negative change in Brazil’s or Argentina’s growing conditions could send the soybean market higher, target the 1060-1080 versus March ‘25 area to make additional sales against your 2024 crop.

- For those with capital needs, consider making these sales into price strength.

2025 Crop:

- We are in the window when targets for additional sales on next year’s crop will start being posted. Though, patience is still recommended since they could be set as late as early spring.

- Be on the lookout for a recommendation to buy call options. A rally to the upper 1100 range versus Nov ’25 could increase the likelihood of an extended rally, and we would recommend buying calls to prepare for that possibility.

2026 Crop:

- Patience is advised. No sales recommendations are currently planned as we monitor the market for more favorable conditions and timing.

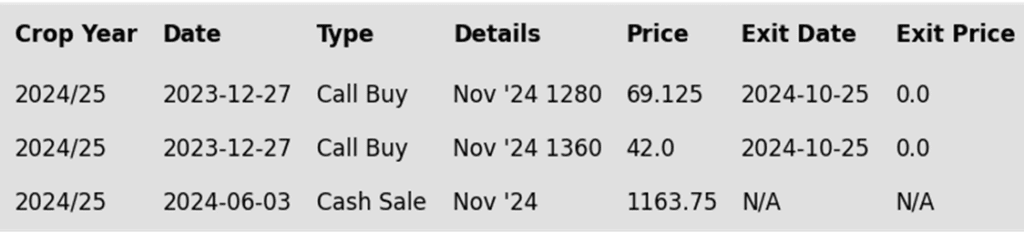

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

- Soybeans opened the week with higher prices as soil moisture levels continue to decline across many regions of Argentina. Growing concerns about rising temperatures and inadequate rainfall are raising the risk of significant challenges for the crop.

- Part of the strength in the soy complex is driven by anticipation ahead of Inauguration Day, as President-elect Trump considers widespread tariffs on several countries, creating uncertainty in the markets. This news resulted in a sharp decline in the U.S. dollar overnight, while boosting commodity prices.

- Soybean meal ended the day with a decline as cold weather and heavy snowstorms swept through the Midwest over the weekend. These weather conditions disrupted soybean processing operations, leading to delays in both production and transportation.

- Farmers in Brazil have reportedly sold 35% of their expected soybean production, up from 20% at this time last year and surpassing the 10-year average of 30%. This increase is partly attributed to the Brazilian currency’s decline to an all-time low against the U.S. dollar.

Above: The recent break in prices found initial support near 950. Initial overhead resistance lies just above the market near 1030 with additional resistance between 1060 and 1075.

Wheat

Market Notes: Wheat

- Wheat futures recouped Friday’s losses, with March KC and Minneapolis contracts leading the rally, while Chicago March wheat closed below Friday’s high. A sharp drop in the U.S. Dollar Index supported U.S. wheat, despite lower Matif wheat prices.

- Weekly wheat inspections at 15.2 mb bring the total 24/25 inspections figure to 467 mb, which is up 25% from the year prior. Inspections are running above the USDA’s estimated pace, and exports are estimated at 850 mb, up 20% from last year.

- Argentina’s wheat crop is 94.7% harvested, up 6.2% week-over-week, with production estimates steady at 18.6 mmt, compared to 15.1 mmt last year.

- Indonesia may impose feed wheat import quotas to protect domestic corn farmers. Despite this, 2023/24 wheat imports are projected at 12.98 mmt, up from 9.45 mmt last year, according to USDA FAS.

Action Plan: Chicago Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

Chicago Wheat Action Plan Summary

2024 Crop:

- Patience is advised regarding sales, as we monitor the market for improved conditions and timing. With harvest underway in the southern hemisphere and winter wheat into dormancy in the northern hemisphere, this can historically be a slow time of the year for the wheat market.

- For those holding open July ’25 860 and 1020 call options that were recommended in May, target a selling price of about 73 cents for the 860 calls to offset the cost of the remaining 1020 calls. Holding the 1020 calls will provide protection for existing sales and give you confidence to make additional sales at higher prices.

2025 Crop:

- Grain Market Insider recently recommended liquidating a portion of previously recommended put options.

- Target the 640 – 665 range versus July ’25 to make additional 2025 HRW wheat sales.

- Continue holding the remaining quarter of the previously recommended July ’25 KC wheat 620 puts to provide downside protection for unsold bushels. Additionally, target the upper 400 range versus July ’25 KC wheat to exit these remaining puts if the market makes new lows.

- If the market rallies considerably, look to protect sales by buying upside calls in the 745 – 770 range versus July ’25. This will also give you confidence to sell more bushels at higher prices.

2026 Crop:

- Patience is advised, as we monitor the market for improved conditions and timing. It may be some time before target ranges are set for the 2026 crop.

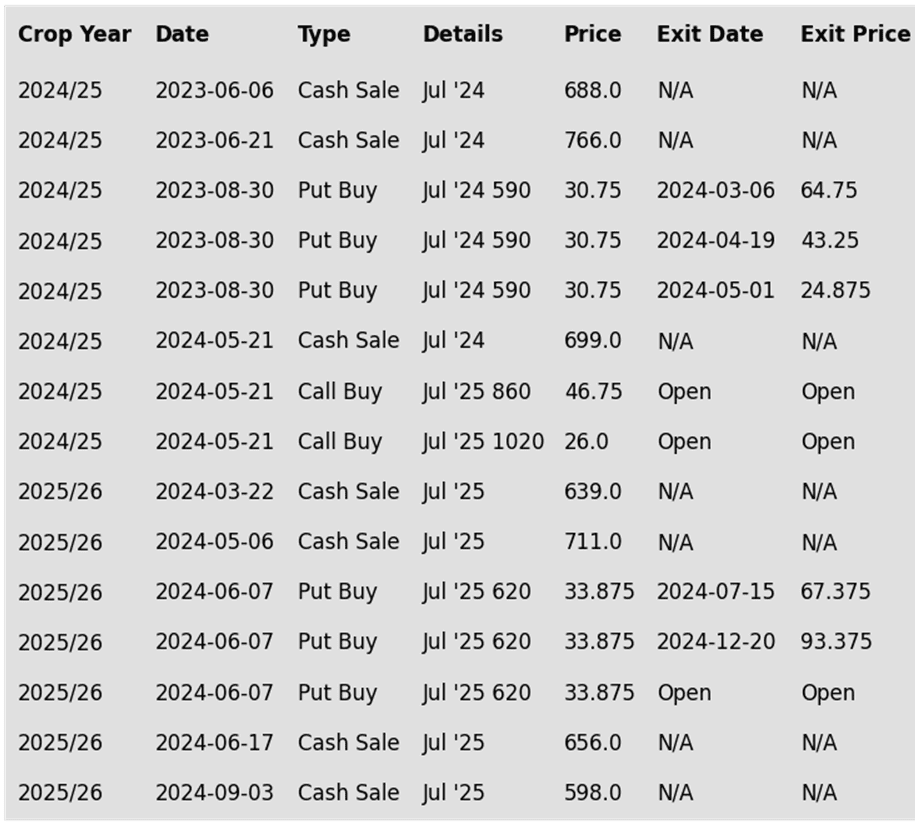

To date, Grain Market Insider has issued the following Chicago wheat recommendations:

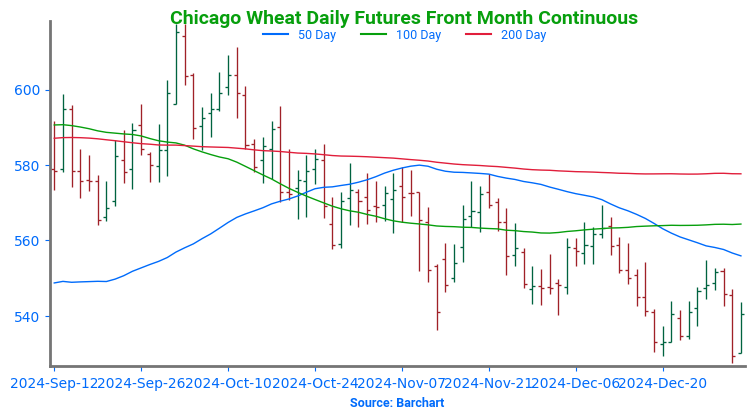

Above: Front-month Chicago wheat remains largely rangebound between 540 and 577. A close above the 577–586 resistance area could set up a retest of 617, while a close below 536 might lead to a slide toward the 521–514 support zone.

Action Plan: KC Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

KC Wheat Action Plan Summary

2024 Crop:

- Target the 635 – 660 versus March ‘25 area to sell more of your 2024 HRW wheat crop.

- For those holding the previously recommended July ’25 860 and 1020 calls, target a selling price of about 71 cents on the 860 calls. This would achieve a net-neutral cost on the remaining 1020 calls, and still give you confidence to sell more bushels at higher prices.

2025 Crop:

- Grain Market Insider recently recommended liquidating a portion of previously recommended put options.

- Look to protect existing sales by buying upside calls in the 745 – 770 range versus July ’25 KC wheat if the market turns higher and rallies considerably. This will also give you confidence to sell more bushels at higher prices.

- Continue holding the remaining quarter of the previously recommended July ’25 KC wheat 620 puts to provide downside protection for unsold bushels. Additionally, target the upper 400 range versus July ’25 KC wheat to exit these remaining puts if the market makes new lows.

2026 Crop:

- Patience is recommended. It may be some time before targets are set for the 2026 crop, as we continue to monitor the market for better conditions and timing.

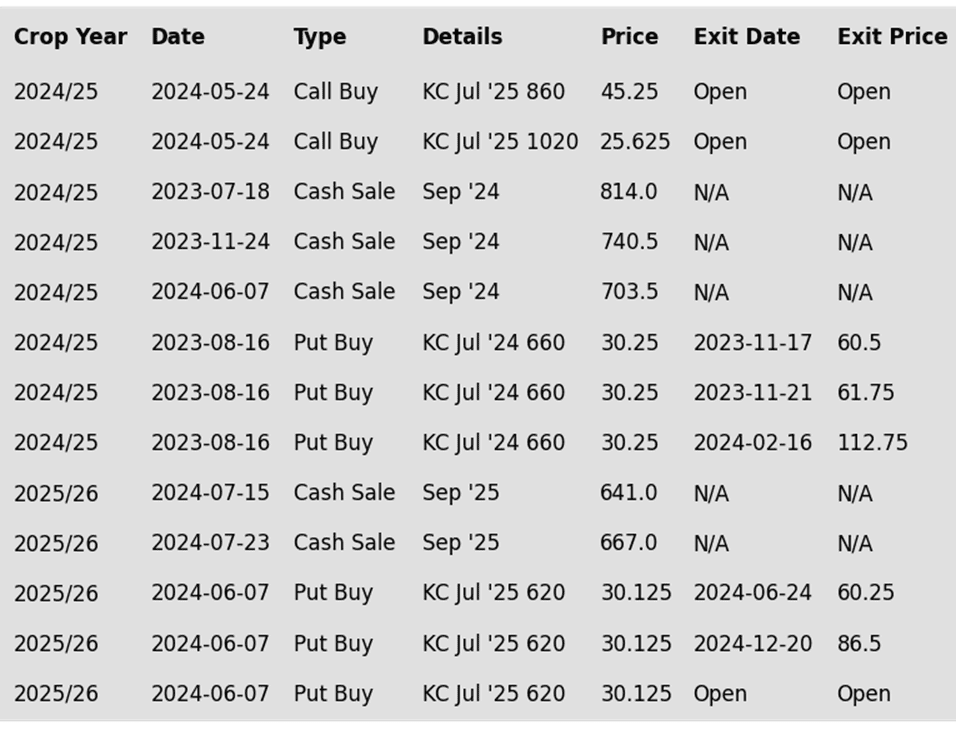

To date, Grain Market Insider has issued the following KC recommendations:

Above: KC wheat remains largely rangebound between 536 and 583, with initial overhead resistance near the 100-day moving average around 568. A close above this level and beyond 583 could set the market up for a test of the 590–595 area, while a close below 536 could put prices at risk of falling to the 525 level.

Action Plan: Mpls Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

Mpls Wheat Action Plan Summary

2024 Crop:

- Target a rally to the 610 – 635 area versus March ‘25 to sell more of your 2024 crop. We are at that time of year when seasonal price trends become more favorable.

- For those holding the previously recommended July ’25 KC wheat 860 and 1020 calls, target a selling price of approximately 71 cents on the 860 calls. This would achieve a net-neutral cost on the remaining 1020 calls and provide confidence to sell more bushels at higher prices.

2025 Crop:

- Grain Market Insider sees a continued opportunity to liquidate half of the remaining open July ’25 620 KC wheat puts at approximately 86 cents in premium minus fees and commission. Back in July Grain Market Insider recommended selling half of the original position to offset the cost of the now remaining puts. Our research shows that, with the July ’25 futures contract down roughly 14% from its October high of 653.75, this is an attractive risk/reward point to exit half of the remaining July ’25 620 KC Wheat put options as we approach the winter dormancy period.

- Look to protect existing sales by buying upside calls in the 745 – 770 range versus July ’25 KC wheat if the market turns higher and rallies considerably. This will also give you confidence to sell more bushels at higher prices.

- Continue holding the remaining half of the previously recommended July ’25 KC wheat 620 puts to provide downside protection for unsold bushels. Additionally, target the upper 400 range versus July ’25 KC wheat to exit half of these remaining puts if the market makes new lows.

2026 Crop:

- Patience is recommended. It may be some time before targets are set for the 2026 crop, as we continue to monitor the market for better conditions and timing.

To date, Grain Market Insider has issued the following Minneapolis wheat recommendations:

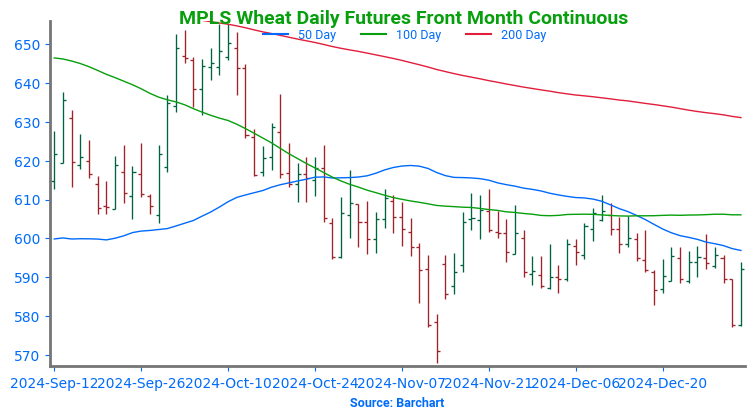

Above: March Minneapolis wheat is rangebound between 585 and 613. A close above 613 could trigger a rally toward 655, with resistance at 624 and 637. A close below 585 may lead to a decline toward 568.

Other Charts / Weather

Above: US 7-day precipitation forecast courtesy of NOAA, Weather Prediction Center.

Above: Argentina two-week forecast total precipitation courtesy of the National Weather Service, Climate Prediction Center.