01-24 End of Day: Lower Export Taxes for Argentina Pressure Grains Friday

All Prices as of 2:00 pm Central Time

| Corn | ||

| MAR ’25 | 486.5 | -3.25 |

| JUL ’25 | 497.5 | -3.25 |

| DEC ’25 | 461 | -3.25 |

| Soybeans | ||

| MAR ’25 | 1055.75 | -9.75 |

| JUL ’25 | 1079.5 | -9 |

| NOV ’25 | 1048.75 | -4.5 |

| Chicago Wheat | ||

| MAR ’25 | 544 | -10 |

| JUL ’25 | 570 | -8.25 |

| JUL ’26 | 625.25 | -7 |

| K.C. Wheat | ||

| MAR ’25 | 559.5 | -11.25 |

| JUL ’25 | 578.5 | -11.25 |

| JUL ’26 | 621.25 | -8.75 |

| Mpls Wheat | ||

| MAR ’25 | 595.25 | -9.25 |

| JUL ’25 | 616.25 | -8.5 |

| SEP ’25 | 626.75 | -8 |

| S&P 500 | ||

| MAR ’25 | 6130.5 | -21.5 |

| Crude Oil | ||

| MAR ’25 | 74.65 | 0.03 |

| Gold | ||

| APR ’25 | 2810.2 | 18.3 |

Grain Market Highlights

- Strong export sales were overpowered by fund profit taking as corn futures slipped lower to end the week.

- Argentina’s announcement of lower export taxes along with an improved weather outlook for much of South America pressured soybean futures on Friday.

- Disappointing export sales and weakness in corn and soybean futures pressured wheat to end the week.

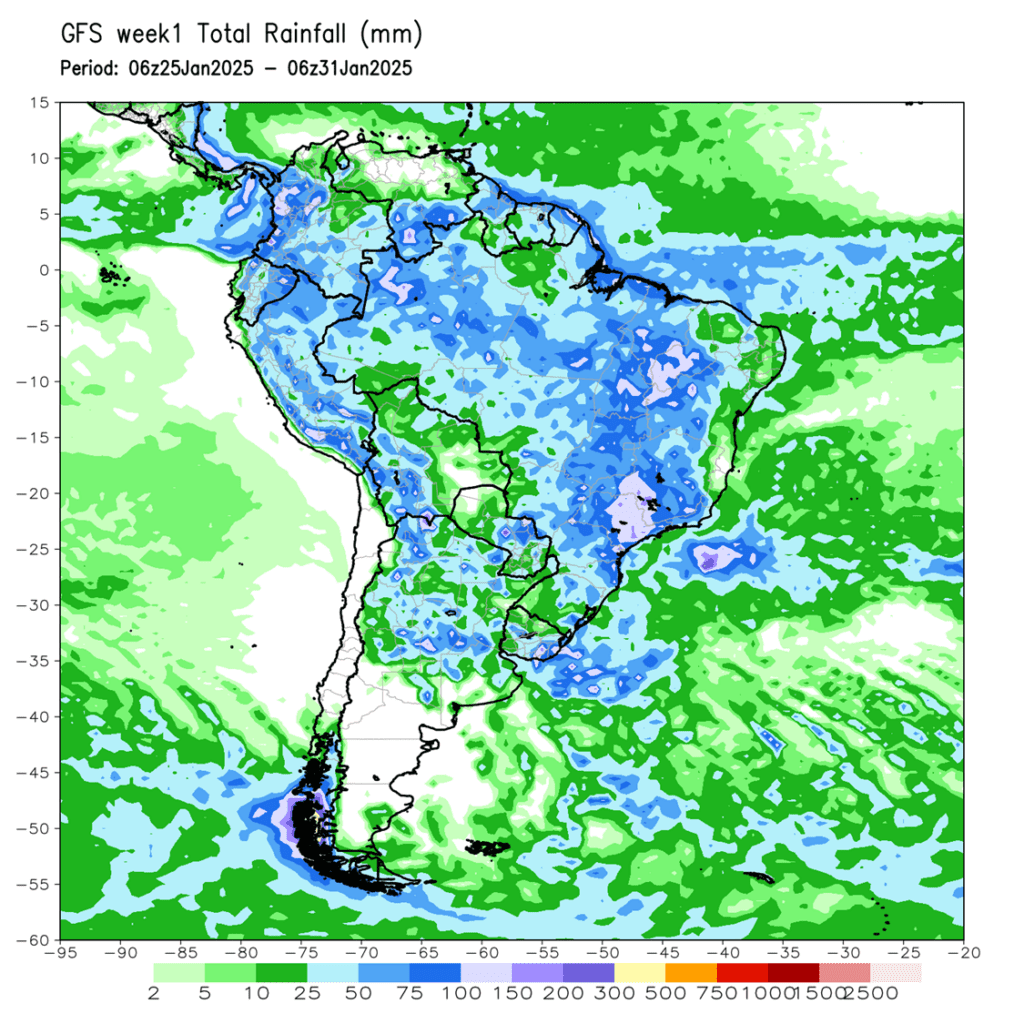

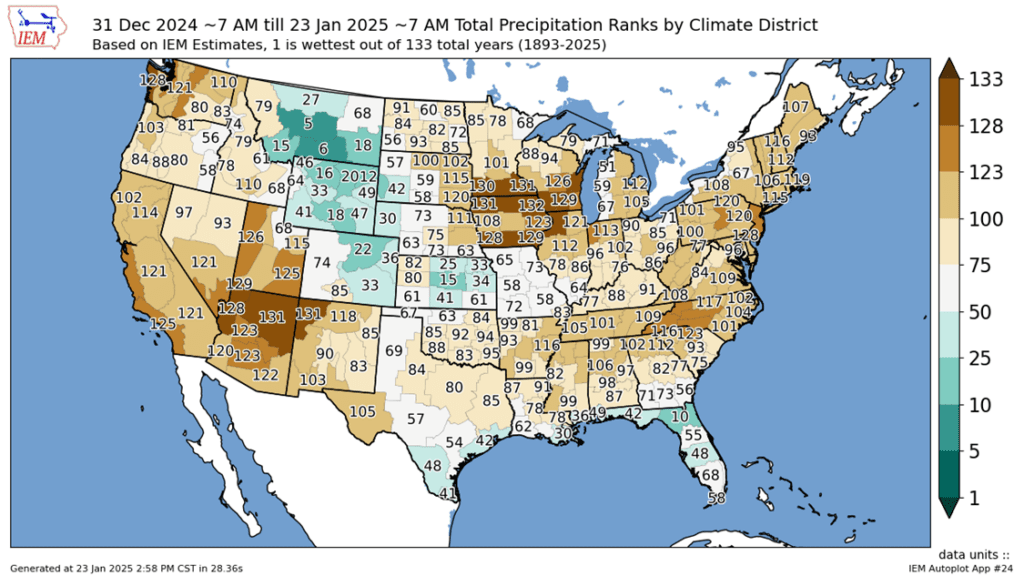

- To see the one-week GFS precipitation forecast for South America as well as the January precipitation ranks by climate district for the U.S. scroll down to the other charts/weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

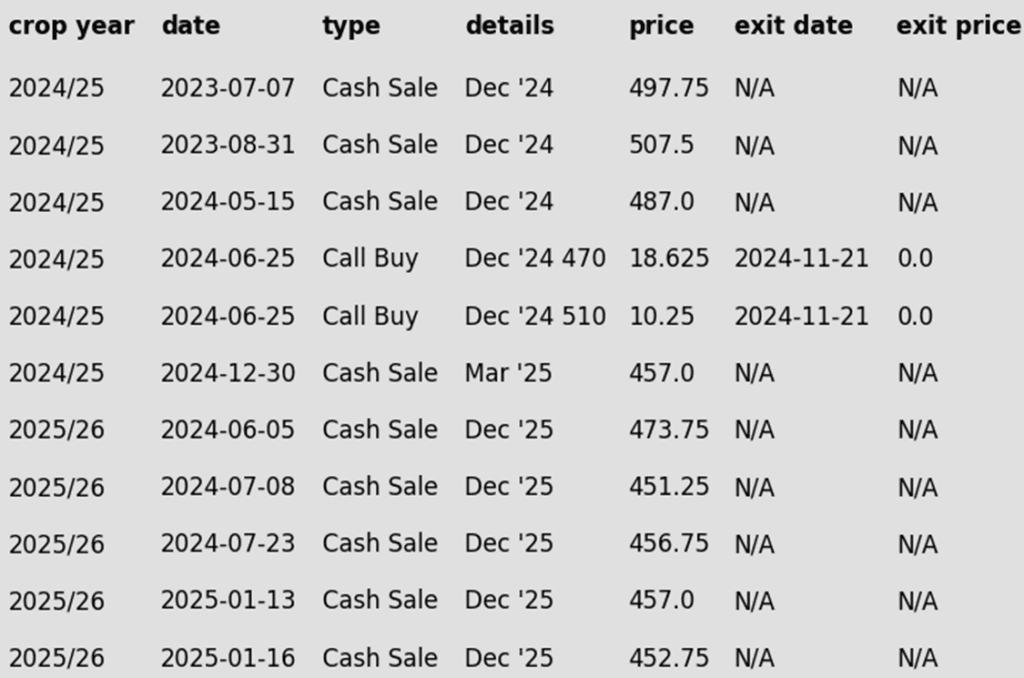

2024 Crop:

- Next Target Range: 495 to 515 for the March ’25 contract.

- Modest Weekly Gain: After two strong weekly gains totaling 33 cents, the March ’25 contract eked out a modest two-cent increase this week, closing slightly higher overall.

- Resistance Levels: On the front-month continuous chart, the next resistance range lies between the September 2021 low of 497.50 and the May 1996 high of 513.50.

- March ’25 Contract Levels: The March ’25 contract has returned to the 487–508 price range, where Grain Market Insider issued its first three sales recommendations for the 2024 corn crop in summer 2023 and spring 2024. To date, four total sales recommendations have been made for the 2024 crop. If you have not yet made all four sales, now is an excellent time to catch up, with prices rebounding to these recommended levels and the market up over 100 cents from the August low on the front-month continuous chart.

2025 Crop:

- Grain Market Insider recently recommended selling another portion of your 2025 corn crop.

- First Resistance: Resistance remains at the October 2024 high of 459.75. Selling near this level is advisable in case this resistance halts further gains in the December ’25 contract.

- Downside Risk: Failure to rally over 459.75 poses the risk of range-bound trading, with the bottom end of the range at 428.00.

- Opportunity: If the December ’25 contract eventually succeeds in rallying above 459.75, the next major resistance level is around 480. Selling near 480 would be the next target for a potential Grain Market Insider sales recommendation.

- Opposing Fundamentals: Strong demand for U.S. corn continues to support the market, but higher prices may incentivize additional planted acres in the U.S. for 2025.

- Buying Call Options: Keep an eye out for a recommendation to purchase call options if prices close above major resistance in the 480 area. This strategy would provide cover to current sales and allow you to benefit from any extended rally.

2026 Crop:

- Hold Recommendation: No sales recommendations are anticipated for the crop to be planted in spring 2026 for at least another 4–6 weeks.

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

- The corn market traded lower to end the week despite another strong week of export sales. End of week profit taking and a cut of export taxes in Argentina weighed on the market.

- The Argentina government announced an export tax cut on agriculture commodities to help support producers in the South American country. Corn export taxes will be reduced from 12% to 9.5% until the end of June. This cut lowers export prices, and stimulates additional producer selling of grains, providing competition for U.S. export business.

- For the week ending January 16, corn export sales reached 1.661 MMT (65.4 mb), coming in at the high end of expectations with South Korea as the primary buyer. Total sales are 29% above last year and running ahead of the pace needed to meet the current USDA target.

- The Buenos Aires Grain Exchange lowered its corn crop projection for this year by 1 MMT this week, citing impacts from hot and dry weather which are limiting crop potential.

- South American weather will stay a driver in the grain markets going into next week’s trade. Forecasts still look improved for Argentina and Southern Brazil, but recent weather has still been less than ideal. Sunday night trade will likely be influenced by the weekend weather.

Above: The uptrend in the corn market remains intact. Initial support below the market lies near 470, with additional support near previous resistance at 450. Larger overhead resistance now comes in just below 500.

Soybeans

Action Plan: Soybeans

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

Active

Sell MAR ’25 Cash

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

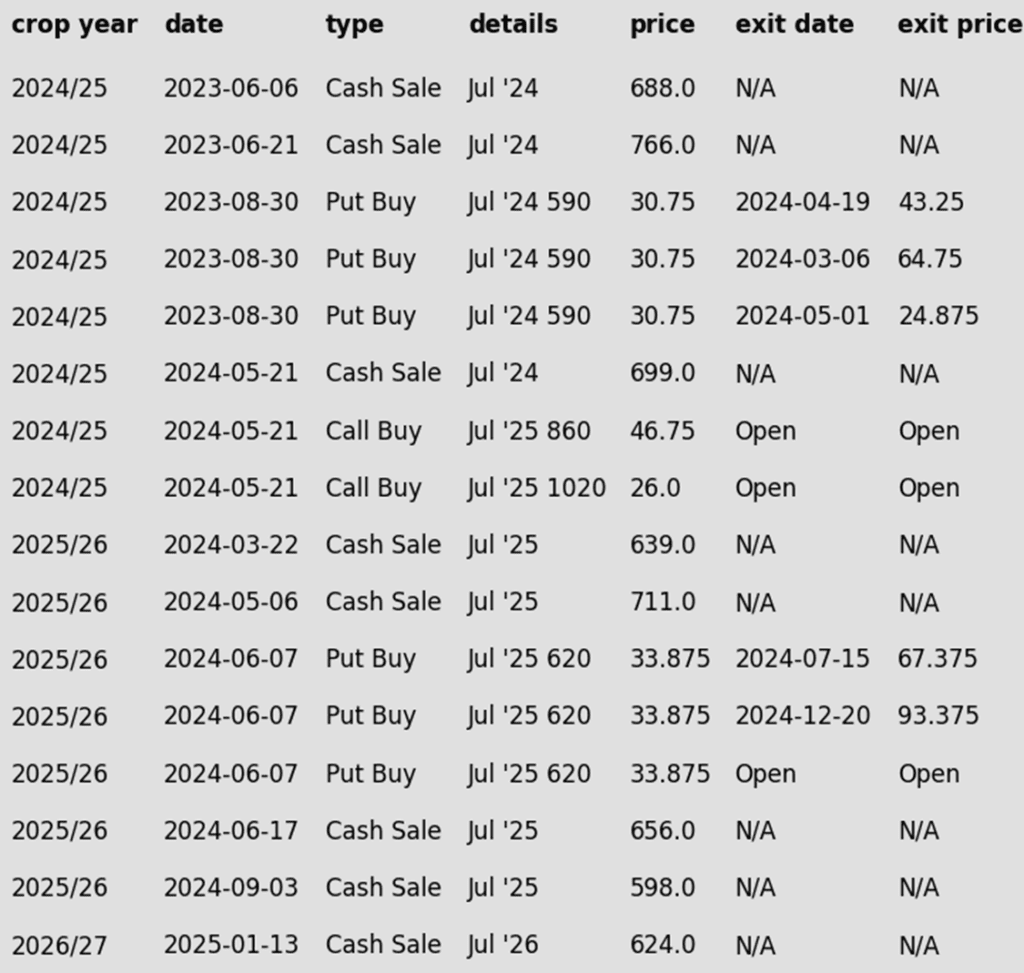

2024 Crop:

- CONTINUED OPPORTUNITY – Grain Market Insider sees a continued opportunity to sell another portion of your 2024 soybean crop.

- Target Range Reached: The March ’25 contract advanced further into the 1060–1080 target range, hitting an intraday high of 1073.50 today. However, the early gains couldn’t hold, and March closed below the 1/14 high of 1064. Out of the three trading days within this range, two have shown bearish reversals, closing back under 1060. This reinforces the strength of the 1060–1080 range as a significant resistance area, which played a key role in today’s sales recommendation.

- From the Lows: The March ‘25 contract remains up over one dollar from its December low of 947.00, marking this as a solid rally worth capitalizing on.

- Fund Activity: Funds have covered a significant number of short positions and are now net-long soybeans, further supporting the idea that now is an ideal time to capitalize on the rally.

2025 Crop:

- Target Range: The target range for issuing the first sales recommendation is 1070–1100 versus Nov ’25.

- Call Buying: Keep an eye out for a potential call option recommendation. Since major resistance lies within this range, it’s possible that both a sales recommendation and a call option recommendation could be issued around the same time.

2026 Crop:

- Hold Recommendation: No sales recommendations are expected until spring.

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

- Soybeans ended the day lower giving back all of yesterday’s gains in the March contract. Yesterday, prices failed at resistance at the 200-day moving average near $10.75. Soybean meal led the way lower as Argentine exports are expected to increase, while soybean oil was slightly higher.

- Yesterday evening, the Argentine government announced that it would cut export taxes on all grains in order to bolster the domestic farming economy. Traders likely see Argentina exports increasing due to this, but weather has improved in the country as well.

- Today’s export sales report was within trade expectations at 54.8 million bushels for 24/25 and 33.1 tb for 25/26. This was up noticeably from the previous week and the 4-week average. Primary destinations were to China, Japan, and Mexico. Last week’s export shipments of 38.0 mb were above the 20.5 mb needed each week to meet the USDA’s estimates.

- For the week, March soybeans gained 21-3/4 cents while November gained 21 cents. March soybean meal gained $7.70 while March soybean oil lost 47 cents.

The 1000 level should act as support on a break lower. Initial overhead resistance lies near the last September highs between 1060 and 1075.

Wheat

Market Notes: Wheat

- Despite a drop in the U.S. Dollar Index, wheat prices fell due to weak corn and soybean markets, poor export sales, and a decline in Paris milling wheat futures.

- Overnight Argentina cut wheat export tax to 9.5% from 12% for the next five months. It was also reported late this week that Russia reduced its wheat tax to 4,430 Rubles/mt, down 5.7%. Historically, reduced export taxes boost farmer selling.

- The USDA reported an increase of only 6.1 mb of wheat exports sales for 24/25, and an increase of 1.9 mb for 25/26. Shipments last week at 7.4 mb also fell below the 18.9 mb pace needed per week to reach the USDA’s export goal of 850 mb. Wheat sales commitments stand at 650 mb, up 7% from last year.

- According to their agriculture ministry, since the season began on July 1 Ukraine’s total grain exports have reached 24.7 mmt, which is up 11% year over year. Wheat shipments specifically have hit 10.6 mmt, which is up 21% year over year.

Action Plan: Chicago Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Target Range: Grain Market Insider continues to target 680–705 vs. March ’25 for the next sale.

- Sales Recommendations to Date: Three sales recommendations have been made so far for the 2024 Chicago wheat crop. The current target range aligns with two previous recommendations. If you are behind on sales, this range offers a good opportunity to make a heavier sale.

- Open Call Options: If you hold the previously recommended July ’25 860 and 1020 call options, continue to hold them. While actionable targets are still distant, these options have approximately five months remaining until their expiration in the third week of June.

2025 Crop:

- Target Range: The next target range for a sale is 690–715 vs. July ’25.

- Sales Recommendations to Date: Grain Market Insider has taken a slightly more aggressive approach with sales for the 2025 crop, leveraging market carry during the overall downtrend from the October high. The average price of the four sales made so far vs. July ’25 is approximately 651. A sale within the current target range would increase that average.

- Open Put Options: One-quarter of the initially recommended 620 July ’25 put option position remains. Scale-out recommendations were provided for the other three-quarters in July and December. The current plan is to continue to hold the remaining position.

2026 Crop:

- Recent Sales Recommendation: Grain Market Insider has recently recommended selling the first portion of the 2026 Chicago wheat crop.

- Next Target Range: The next target range for a sale on the 2026 crop is 700–720 vs July ‘26.

- Carry & Increased Volume: The growing daily trading volume and approximately 50 cents of additional carry in the July ’26 contract compared to the July ’25 contract make the July ’26 contract an early opportunity to monitor closely.

To date, Grain Market Insider has issued the following Chicago Wheat recommendations:

Front-month Chicago wheat remains largely rangebound between 540 and 577. A close above the 577–586 resistance area could set up a retest of 617, while a close below 536 might lead to a slide toward the 521–514 support zone.

Action Plan: KC Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Target Range: 650 – 700 vs. March ‘25 area to sell more of your 2024 HRW wheat crop.

- Sales Recommendations to Date: Grain Market Insider has issued only two sales recommendations to date, reflecting the significant yield uncertainty before last year’s harvest and the limited post-harvest sales opportunities. These two recommendations, though widely spaced, averaged approximately 719 vs. the July ’24 futures. A sale at the next target range will reduce the average, but upside expectations remain tempered for now

- Open Call Options: If you hold the previously recommended July ’25 860 and 1020 call options, continue to hold them. While actionable targets are still distant, these options have approximately five months remaining until their expiration in the third week of June.

2025 Crop:

- Target Range: 640 – 665 range vs. July ‘25 to make an additional sale for your 2025 HRW wheat crop.

- Open Put Options: One-quarter of the initially recommended 620 July ’25 put option position remains. Scale-out recommendations were provided for the other three-quarters in July and December. The current plan is to continue to hold the remaining position.

2026 Crop:

- Hold Recommendation: No first sales recommendations are expected until late spring or early summer.

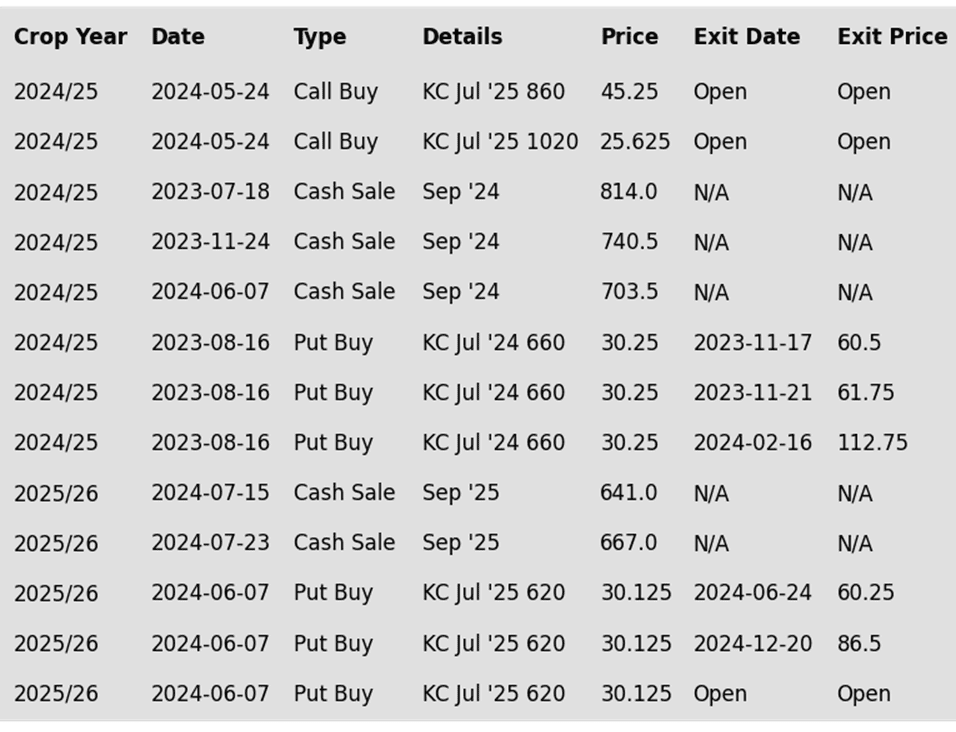

To date, Grain Market Insider has issued the following KC recommendations:

KC wheat remains largely rangebound between 536 and 583, with initial overhead resistance near the 100-day moving average around 568. A close above this level and beyond 583 could set the market up for a test of the 590–595 area, while a close below 536 could put prices at risk of falling to the 525 level.

Action Plan: Mpls Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Potential Target Range: A rally to the 610–635 range vs. March ’25 is the initial target for another sale of your 2024 HRS wheat crop. However, the near-record short position held by Funds suggests that this target range could adjust higher as future price action unfolds.

- Open Call Options: If you hold the previously recommended KC July ’25 860 and 1020 call options, continue to hold them. While actionable targets are still distant, these options have approximately five months remaining until their expiration in the third week of June.

2025 Crop:

- Target Range: 700 – 750 is the target range vs September ‘25.

- Open Put Options: One-quarter of the initially recommended KC 620 July ’25 put option position remains. Scale-out recommendations were provided for the other three-quarters in July and December. The current plan is to continue to hold the remaining position.

2026 Crop:

- Hold Recommendation: No first sales recommendations are expected until early summer.

To date, Grain Market Insider has issued the following Minneapolis wheat recommendations:

March Minneapolis wheat is rangebound between 585 and 613. A close above 613 could trigger a rally toward 655, with resistance at 624 and 637. A close below 585 may lead to a decline toward 568.

Other Charts / Weather