01-22 End of Day: Corn Retreats from Multi-Month Highs

All Prices as of 2:00 pm Central Time

| Corn | ||

| MAR ’25 | 484.25 | -5.75 |

| JUL ’25 | 495.75 | -5.25 |

| DEC ’25 | 459.5 | -0.25 |

| Soybeans | ||

| MAR ’25 | 1056 | -11.25 |

| JUL ’25 | 1078.75 | -8.5 |

| NOV ’25 | 1046.75 | -3 |

| Chicago Wheat | ||

| MAR ’25 | 554 | -4.75 |

| JUL ’25 | 578.25 | -3.5 |

| JUL ’26 | 634 | -3 |

| K.C. Wheat | ||

| MAR ’25 | 574.75 | -0.75 |

| JUL ’25 | 594 | -0.5 |

| JUL ’26 | 635.5 | -0.75 |

| Mpls Wheat | ||

| MAR ’25 | 606.5 | 2 |

| JUL ’25 | 627.25 | 1.5 |

| SEP ’25 | 637 | 0.75 |

| S&P 500 | ||

| MAR ’25 | 6127 | 42.75 |

| Crude Oil | ||

| MAR ’25 | 75.47 | -0.36 |

| Gold | ||

| APR ’25 | 2794 | 8.4 |

Grain Market Highlights

- The corn market retreated from multi-month highs today, pressured by technical overbought conditions.

- Soybean futures closed lower as an improved weather outlook for South America eased concerns about crop stress.

- Wheat futures ended in the red, with Chicago leading the losses. Weakness in corn and soybeans spilled over into wheat, amplifying the selloff.

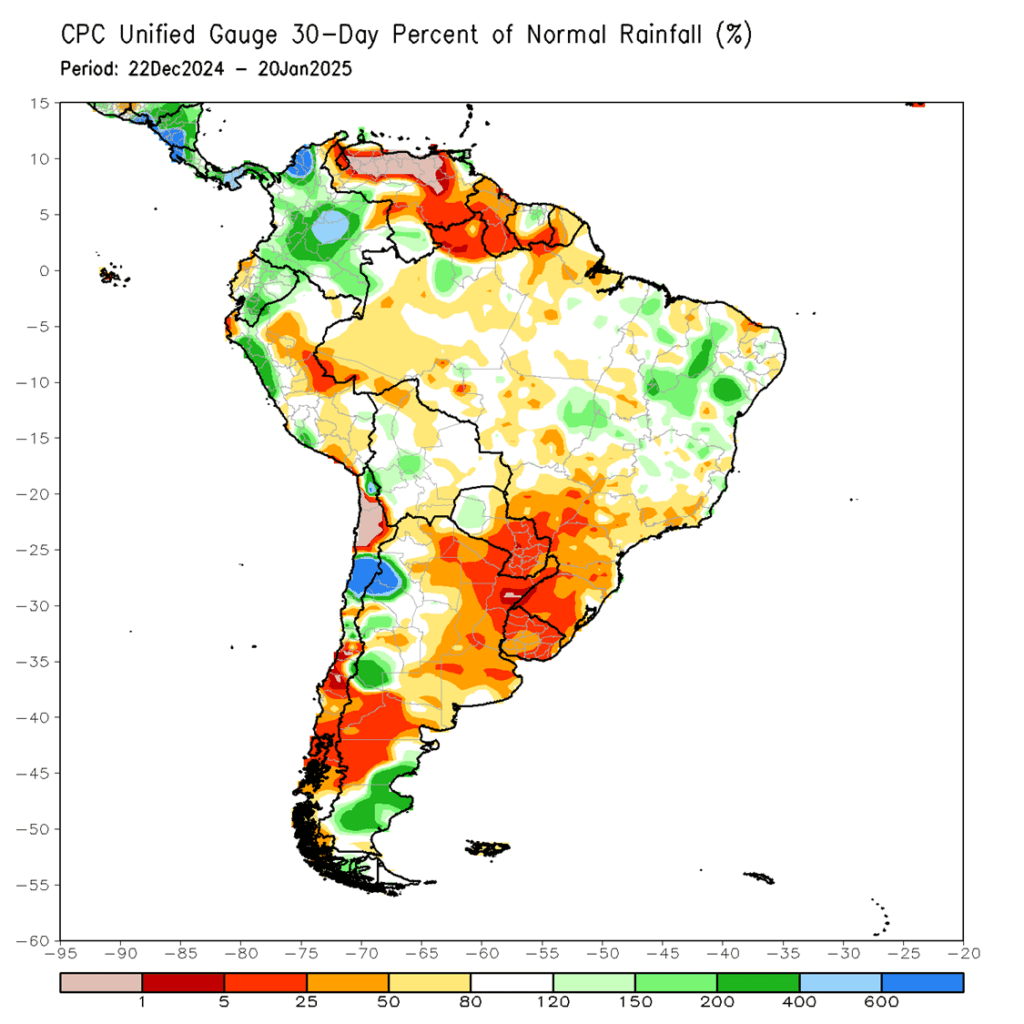

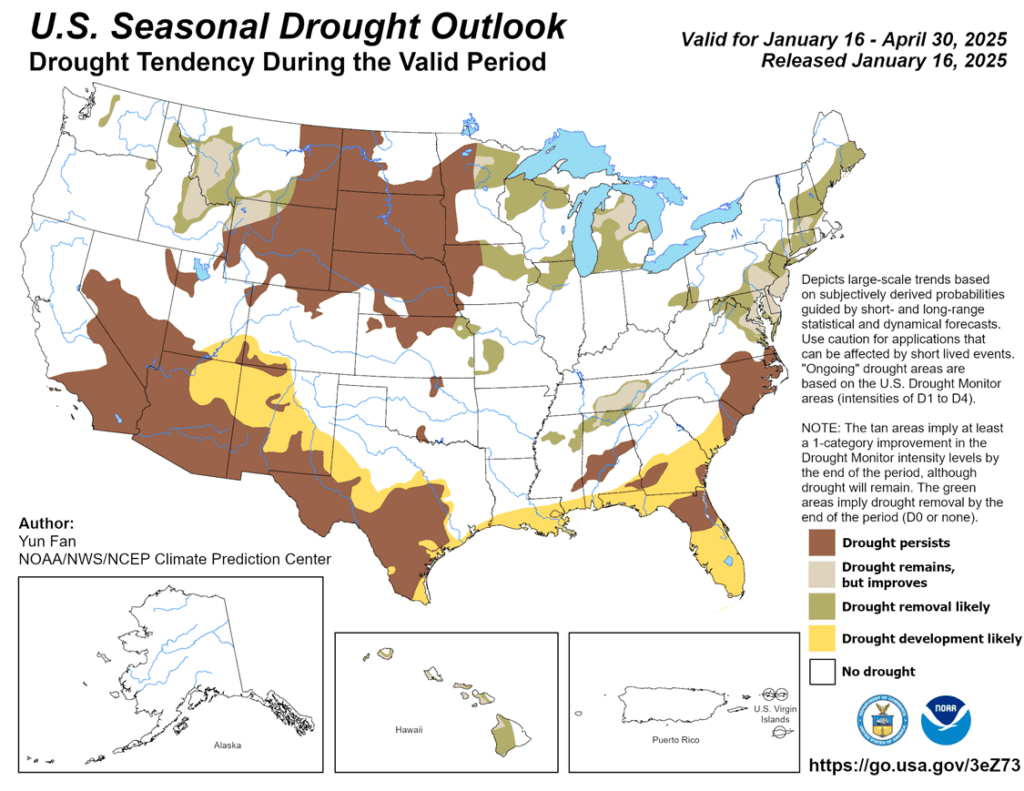

- To see the 30-day percent of normal rainfall map for South America as well as the U.S. seasonal drought outlook, scroll down to the other charts/weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

Active

Sell DEC ’25 Cash

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

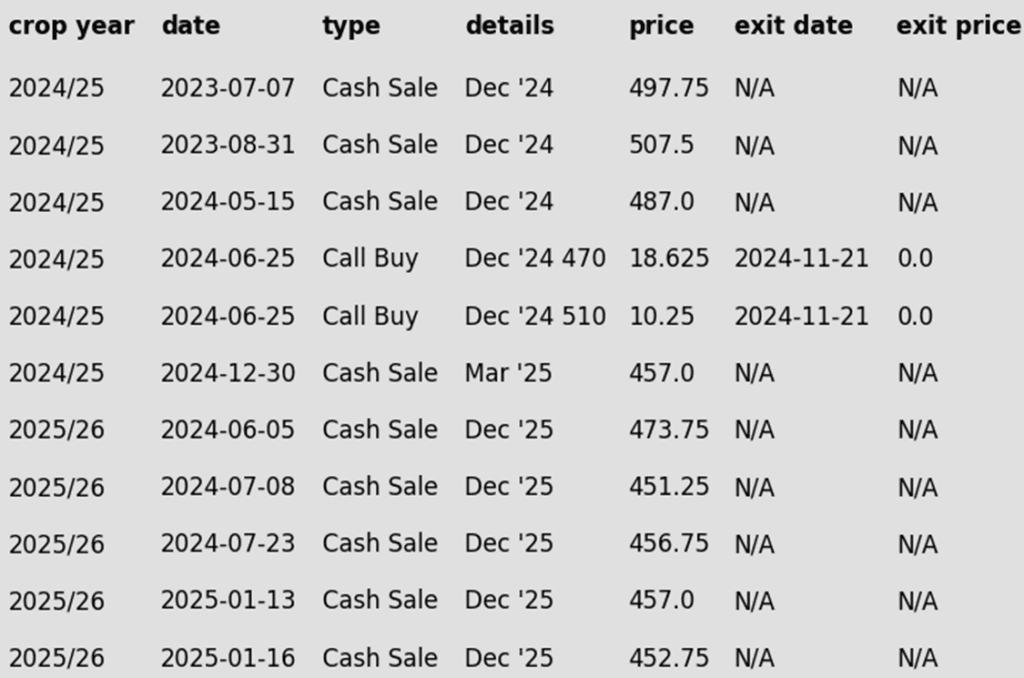

2024 Crop:

- Next Target Range: 495 to 515 for the March ’25 contract.

- Weekly Close: The March ’25 contract posted a strong weekly close last week, finishing above the May 2024 high of 475.50. This marks the highest close since the week of December 4, 2023.

- Resistance Levels: On the front-month continuous chart, the next resistance range lies between the September 2021 low of 497.50 and the May 1996 high of 513.50.

- March ’25 Contract Levels: The March ’25 contract has returned to the 487–508 price range, where Grain Market Insider issued its first three sales recommendations for the 2024 corn crop in summer 2023 and spring 2024. To date, four total sales recommendations have been made for the 2024 crop. If you have not yet made all four sales, now is an excellent time to catch up, with prices rebounding to these recommended levels and the market up over 100 cents from the August low on the front-month continuous chart.

2025 Crop:

- CONTINUED OPPORTUNITY – Grain Market Insider sees a continued opportunity to sell another portion of your 2025 corn crop.

- First Resistance: Resistanceremains at the October 2024 high of 459.75. Selling near this level is advisable in case this resistance halts further gains in the December ’25 contract.

- Downside Risk: Failure to rally over 459.75 poses the risk of range-bound trading, with the bottom end of the range at 428.00.

- Opportunity: If the December ’25 contract eventually succeeds in rallying above 459.75, the next major resistance level is around 480. Selling near 480 would be the next target for a potential Grain Market Insider sales recommendation.

- Opposing Fundamentals: Strong demand for U.S. corn continues to support the market, but higher prices may incentivize additional planted acres in the U.S. for 2025.

- Buying Call Options: Keep an eye out for a recommendation to purchase call options if prices close above major resistance in the 480 area. This strategy would provide cover to current sales and allow you to benefit from any extended rally.

2026 Crop:

- Hold Recommendation: No sales recommendations are anticipated for the crop to be planted in spring 2026 for at least another 4–6 weeks.

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

- Corn prices finished the day lower after making 8-month highs early on. Improved weather patterns in South America weighed on the market, contributing to the late-session pullback.

- The USDA announced a private export sale of 136,000 MT of corn to unknown destinations for 2024/25 delivery. While this news supported prices early in the session, the market ultimately faded by the close.

- S&P global raised their 2025 corn acre forecast to 93.5 mmt. This is up 700,000 acres from their forecast in December and nearly 3 million acres more than 2024.

- The corn market treads in overbought territory with funds now estimated to be long over 320,000 contracts. Many feel it would take worsening conditions in South America to sustain rallies above the $5.00 level.

- Weekly ethanol production data has been delayed until Thursday morning due to Monday’s holiday.

Above: The uptrend in the corn market remains intact. Initial support below the market lies near 470, with additional support near previous resistance at 450. Larger overhead resistance now comes in just below 500.

Soybeans

Action Plan: Soybeans

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

New Alert

Sell MAR ’25 Cash

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

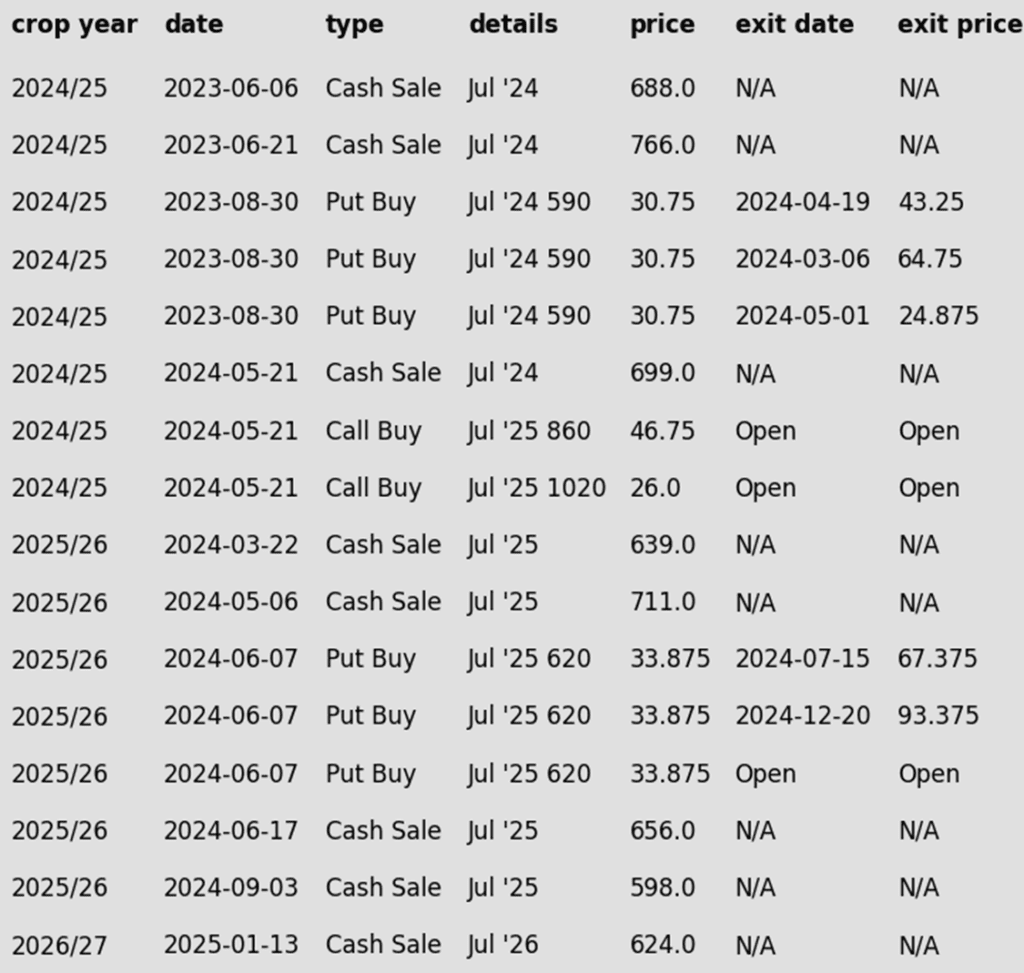

2024 Crop:

- NEW ACTION – Grain Market Insider recommends selling another portion of your 2024 soybean crop.

- Target Range Reached: The March ’25 contract advanced further into the 1060–1080 target range, hitting an intraday high of 1073.50 today. However, the early gains couldn’t hold, and March closed below the 1/14 high of 1064. Out of the three trading days within this range, two have shown bearish reversals, closing back under 1060. This reinforces the strength of the 1060–1080 range as a significant resistance area, which played a key role in today’s sales recommendation.

- From the Lows: At Tuesday’s close of 1067.25, the contract stood over one dollar above its December low of 947.00, marking a solid rally worth capitalizing on.

- Fund Activity: Funds have covered a significant number of short positions and are now net-long soybeans, further supporting the idea that now is an ideal time to capitalize on the rally.

2025 Crop:

- Target Range: The target range for issuing the first sales recommendation is 1070–1100 versus Nov ’25.

- Call Buying: Keep an eye out for a potential call option recommendation. Since major resistance lies within this range, it’s possible that both a sales recommendation and a call option recommendation could be issued around the same time.

2026 Crop:

- Hold Recommendation: No sales recommendations are expected until spring.

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

- Soybeans ended the day lower, taking back a portion of yesterday’s impressive gains. Yesterday’s rally was fueled by a sharp drop in the dollar, wet Brazilian harvest conditions, and an issue with grain shipments from Brazil to China. Today was likely a technical pullback that was accelerated by lower soybean oil while soybean meal ended higher.

- Yesterday, it was reported that Brazilian shipments of soybeans were suspended by China after 5 different Chinese firms found that the shipments did not meet phytosanitary requirements. There were concerns after some cargoes were found with chemical contamination, pests, or insects.

- President Trump has indicated that tariffs were coming for Canada and Mexico on February 1, and today it was reported that a 10% tariff on all Chinese imports would be put in place on the 1st as well. While this was expected, the Chinese stock market fell, and exports of soybeans could be affected due to retaliations.

- Weather in South America remains mixed: Argentina continues to see necessary rain, while persistent rainfall in Brazil is delaying the harvest and raising potential quality concerns. Brazilian soybeans were planted late, however, so a later harvest would be expected.

The 1000 level should act as support on a break lower. Initial overhead resistance lies near the last September highs between 1060 and 1075.

Wheat

Market Notes: Wheat

- Wheat joined corn and soybeans in posting losses, with the Chicago contract leading the decline. Factors contributing to the weaker trade included profit-taking, a lower close for Matif wheat, and uncertainty surrounding potential tariffs and sanctions.

- S&P Global increased their 2025 total acreage forecast by 1.1 million to 47.1 million acres. Their winter wheat projection in particular stands at 34.115 million acres, which is in line with the most recent USDA estimate.

- SovEcon left their estimate of 2025 Russian wheat production steady at 78.7 mmt, which would be the lowest since 2021. With that said, if a significant cold spell occurs, minimal snow cover means that winterkill could be an issue that reduces overall production.

- According to the GASC vice chairman, Egypt intends to import between 5-6 mmt of wheat during the 24/25 season for their subsidized bread program. Total season imports are anticipated at 12.5 mmt; Egypt is one of the top global importers of wheat.

Action Plan: Chicago Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Target Range: Grain Market Insider continues to target 680–705 vs. March ’25 for the next sale.

- Sales Recommendations to Date: Three sales recommendations have been made so far for the 2024 Chicago wheat crop. The current target range aligns with two previous recommendations. If you are behind on sales, this range offers a good opportunity to make a heavier sale.

- Open Call Options: If you hold the previously recommended July ’25 860 and 1020 call options, continue to hold them. While actionable targets are still distant, these options have approximately five months remaining until their expiration in the third week of June.

2025 Crop:

- Target Range: The next target range for a sale is 690–715 vs. July ’25.

- Sales Recommendations to Date: Grain Market Insider has taken a slightly more aggressive approach with sales for the 2025 crop, leveraging market carry during the overall downtrend from the October high. The average price of the four sales made so far vs. July ’25 is approximately 651. A sale within the current target range would increase that average.

- Open Put Options: One-quarter of the initially recommended 620 July ’25 put option position remains. Scale-out recommendations were provided for the other three-quarters in July and December. The current plan is to continue to hold the remaining position.

2026 Crop:

- Recent Sales Recommendation: Grain Market Insider has recently recommended selling the first portion of the 2026 Chicago wheat crop.

- Next Target Range: The next target range for a sale on the 2026 crop is 700–720 vs July ‘26.

- Carry & Increased Volume: The growing daily trading volume and approximately 50 cents of additional carry in the July ’26 contract compared to the July ’25 contract make the July ’26 contract an early opportunity to monitor closely.

To date, Grain Market Insider has issued the following Chicago Wheat recommendations:

Front-month Chicago wheat remains largely rangebound between 540 and 577. A close above the 577–586 resistance area could set up a retest of 617, while a close below 536 might lead to a slide toward the 521–514 support zone.

Action Plan: KC Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Target Range: 650 – 700 vs. March ‘25 area to sell more of your 2024 HRW wheat crop.

- Sales Recommendations to Date: Grain Market Insider has issued only two sales recommendations to date, reflecting the significant yield uncertainty before last year’s harvest and the limited post-harvest sales opportunities. These two recommendations, though widely spaced, averaged approximately 719 vs. the July ’24 futures. A sale at the next target range will reduce the average, but upside expectations remain tempered for now

- Open Call Options: If you hold the previously recommended July ’25 860 and 1020 call options, continue to hold them. While actionable targets are still distant, these options have approximately five months remaining until their expiration in the third week of June.

2025 Crop:

- Target Range: 640 – 665 range vs. July ‘25 to make an additional sale for your 2025 HRW wheat crop.

- Open Put Options: One-quarter of the initially recommended 620 July ’25 put option position remains. Scale-out recommendations were provided for the other three-quarters in July and December. The current plan is to continue to hold the remaining position.

2026 Crop:

- Hold Recommendation: No first sales recommendations are expected until late spring or early summer.

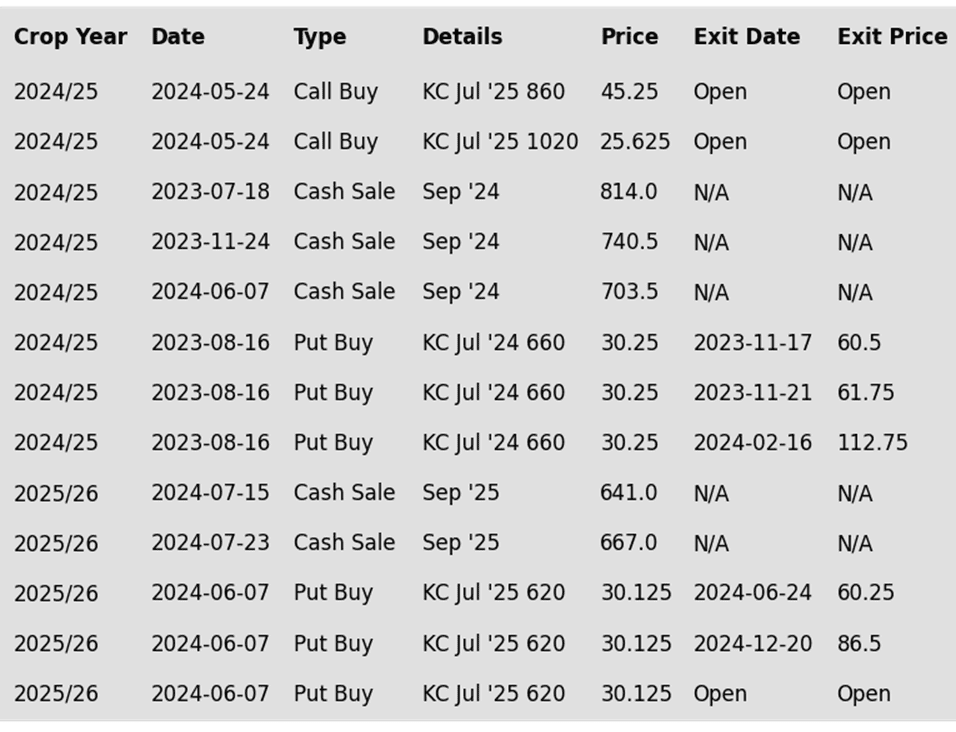

To date, Grain Market Insider has issued the following KC recommendations:

KC wheat remains largely rangebound between 536 and 583, with initial overhead resistance near the 100-day moving average around 568. A close above this level and beyond 583 could set the market up for a test of the 590–595 area, while a close below 536 could put prices at risk of falling to the 525 level.

Action Plan: Mpls Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Potential Target Range: A rally to the 610–635 range vs. March ’25 is the initial target for another sale of your 2024 HRS wheat crop. However, the near-record short position held by Funds suggests that this target range could adjust higher as future price action unfolds.

- Open Call Options: If you hold the previously recommended KC July ’25 860 and 1020 call options, continue to hold them. While actionable targets are still distant, these options have approximately five months remaining until their expiration in the third week of June.

2025 Crop:

- Target Range: 700 – 750 is the target range vs September ‘25.

- Open Put Options: One-quarter of the initially recommended KC 620 July ’25 put option position remains. Scale-out recommendations were provided for the other three-quarters in July and December. The current plan is to continue to hold the remaining position.

2026 Crop:

- Hold Recommendation: No first sales recommendations are expected until early summer.

To date, Grain Market Insider has issued the following Minneapolis wheat recommendations:

March Minneapolis wheat is rangebound between 585 and 613. A close above 613 could trigger a rally toward 655, with resistance at 624 and 637. A close below 585 may lead to a decline toward 568.

Other Charts / Weather