01-03 End of Day: Wheat Continues its New Year’s Slide as Corn and Beans Rebound Slightly

All prices as of 2:00 pm Central Time

| Corn | ||

| MAR ’24 | 465.25 | 1.5 |

| JUL ’24 | 488.25 | 0.5 |

| DEC ’24 | 498.5 | 0.25 |

| Soybeans | ||

| MAR ’24 | 1277 | 3.5 |

| JUL ’24 | 1291 | 4.5 |

| NOV ’24 | 1225.25 | 3.25 |

| Chicago Wheat | ||

| MAR ’24 | 600.25 | -6.5 |

| JUL ’24 | 622 | -4.25 |

| JUL ’25 | 658.5 | -2.25 |

| K.C. Wheat | ||

| MAR ’24 | 621.5 | -7.5 |

| JUL ’24 | 628.5 | -6 |

| JUL ’25 | 661 | 1.5 |

| Mpls Wheat | ||

| MAR ’24 | 708.5 | -6.5 |

| JUL ’24 | 727.25 | -6.5 |

| DEC ’24 | 750.25 | -2.75 |

| S&P 500 | ||

| MAR ’24 | 4764.25 | -23 |

| Crude Oil | ||

| MAR ’24 | 72.96 | 2.34 |

| Gold | ||

| APR ’24 | 2064.4 | -29.1 |

Grain Market Highlights

- March corn saw two-sided trade and a fresh contract low before recovering and closing near the top of the range. A general lack of friendly news is adding resistance to corn prices.

- This past weekend’s rain in Brazil and the forecast for more continued to weigh on the soybean market earlier in the day before prices recovered as traders began looking toward next week’s USDA update.

- Rallies in soybean meal and oil lent additional support to the soybean market and raised Board crush margins by 2 cents. Both products saw both sides of unchanged before settling in the upper end of their respective ranges.

- Despite renewed Russian attacks on the port of Odesa, and expectations of a winter storm and cold temperatures in Russia and Ukraine, all three classes of wheat continued their slide lower, closing toward the lower end of their respective ranges, with a rising US dollar contributing additional pressure to prices.

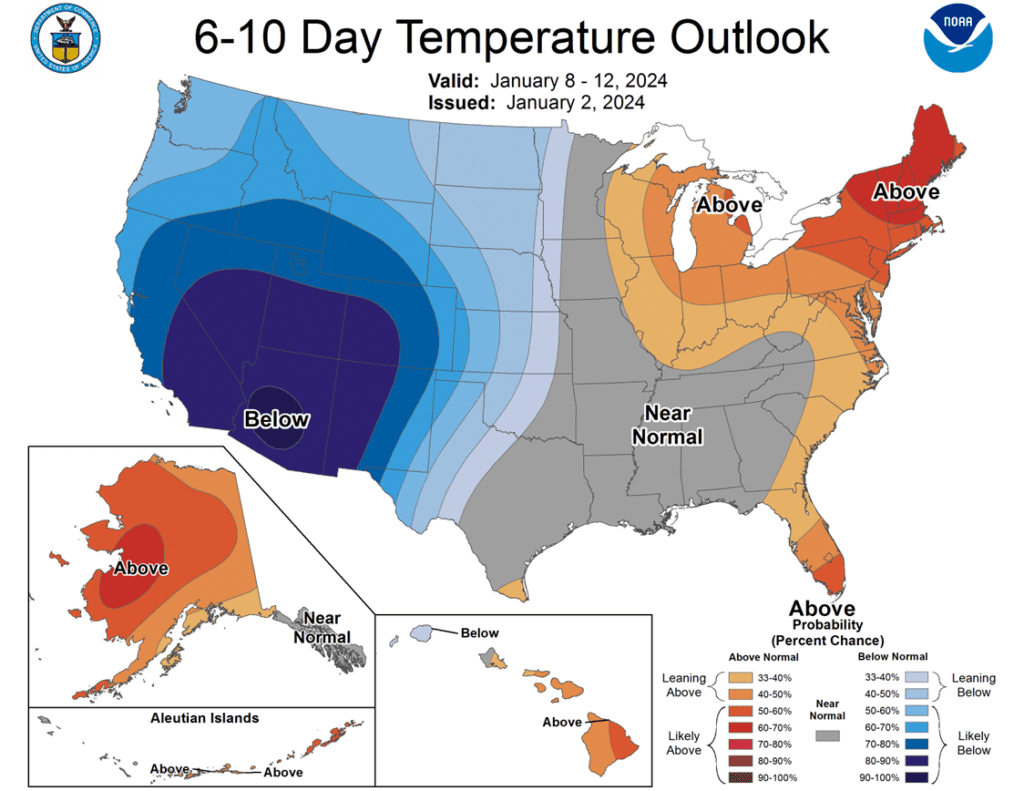

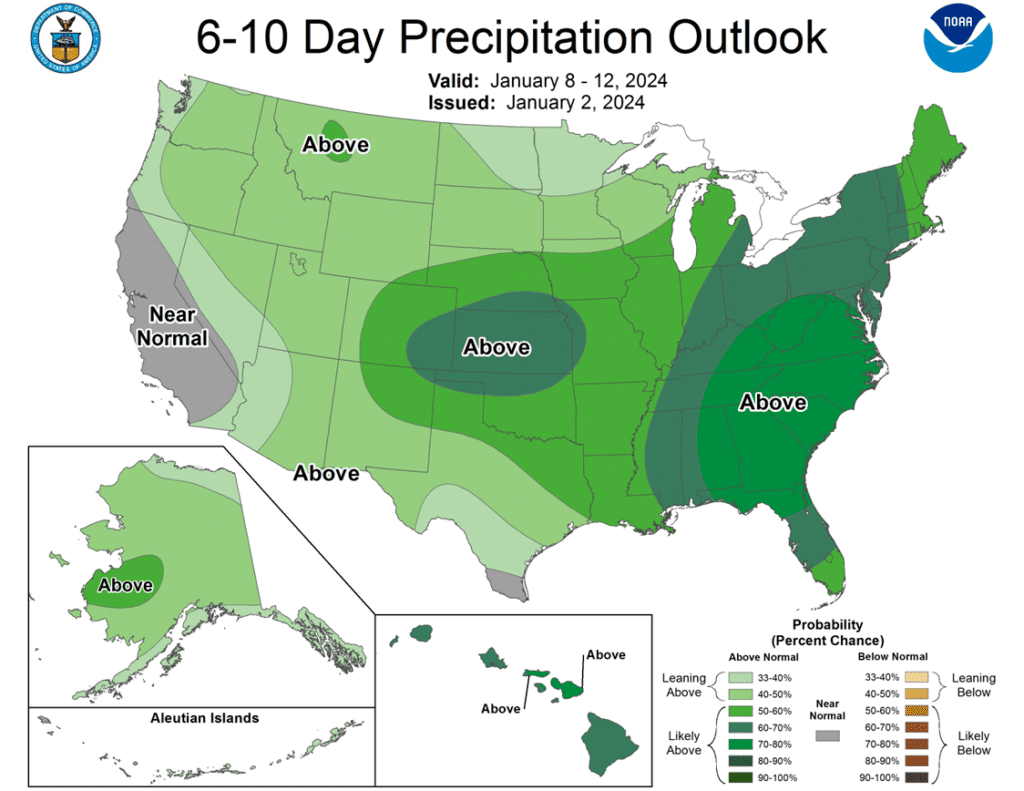

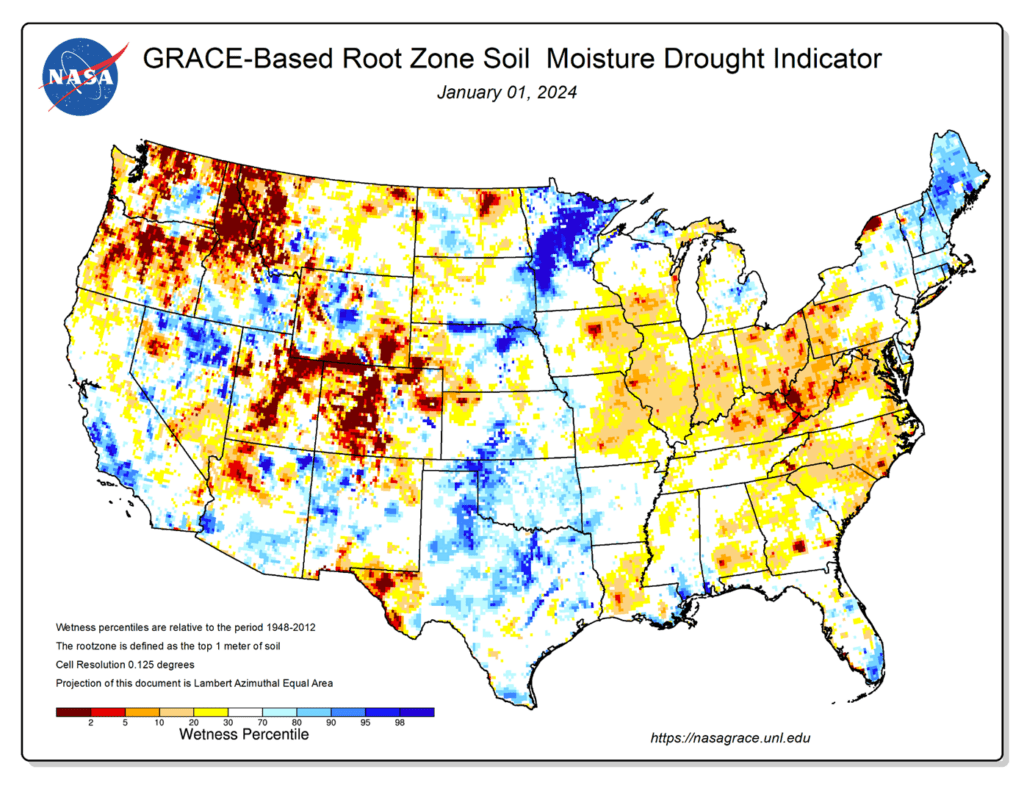

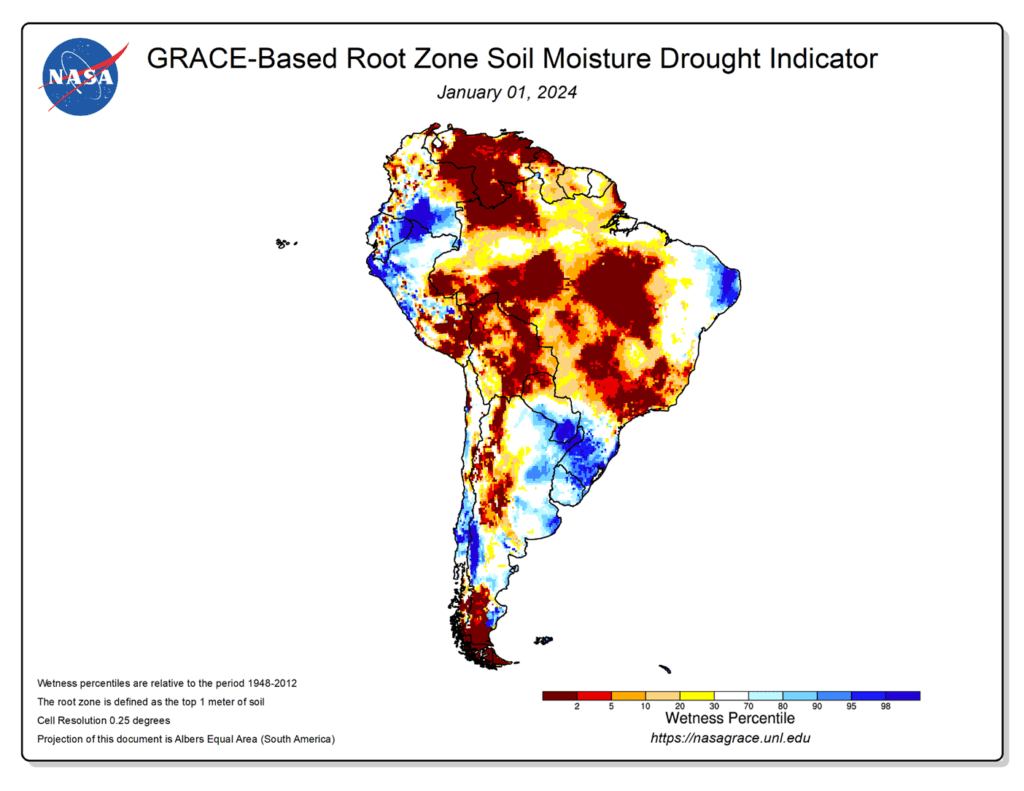

- To see the updated US 6-10 day temperature and precipitation outlooks, and GRACE-Based drought indicators for North and South America courtesy of NWS, NOAA, NDMC, and NASA scroll down to other Charts/Weather Section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2023

No New Action

2024

No New Action

2025

No New Action

Cash

2023

No New Action

2024

No New Action

2025

No New Action

Puts

2023

No New Action

2024

No New Action

2025

No New Action

Corn Action Plan Summary

- No new action is recommended for 2023 corn. Since the beginning of August, the corn market has traded sideways largely between 470 and 500. October’s brief breakout to 509 ½ and the subsequent failure to stay above the 50-day moving average indicates there is significant resistance in that price range. The failure of December’s USDA report to provide a bullish influence on the market puts the market at risk of drifting sideways to lower without a bullish catalyst. During last summer’s June rally, Grain Market Insider recommended making sales when Dec ’23 was around 624. For now, Grain Market Insider will continue to hold tight on any further sales recommendations for the next few weeks with the objective of seeking out better pricing opportunities. If the market has not turned around by then, Grain Market Insider may sit tight on the next sales recommendations until spring.

- No new action is recommended for 2024 corn. Since late February ’22, Dec ’24 has been bound by 485 ¾ on the bottom and 602 on the top. During this time, Dec ’24 has held up better as bear spreading has allowed Dec ’24 to maintain more of its value versus old crop prices as traders attempt to price in a larger 2023 carryout with more uncertainty remaining for the 2024 crop. Moving forward, the risk for 2024 prices is the same as for 2023 prices, which is a continuation of a sideways to lower trend without a bullish catalyst. Grain Market Insider is watching for signs of a change in the current trend to look at recommending making additional sales and buying Dec ’24 call options. This past spring, Grain Market Insider recommended buying Dec ‘23 560 and 610 call options ahead of the summer rally and having those in place helped provide confidence to pull the trigger on recommending 2023 sales into that sharp rally, knowing that if corn kept rallying and went to 700 or 800 that the call options would protect those sold bushels.

- No Action is currently recommended for 2025 corn. Grain Market Insider isn’t considering any recommendations at this time for the 2025 crop that will be planted two springs from now. It will probably be late winter or early spring of 2024 before Grain Market Insider starts considering the first sales targets.

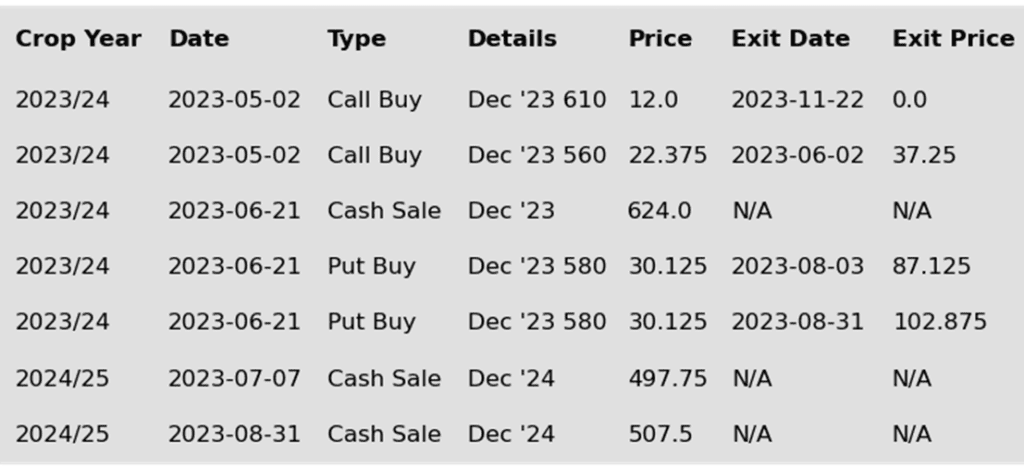

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

- Corn futures set a new contract low for the March contract before seeing some positive price action to finish with slim gains. March corn gained 1 ½ cents on the session.

- Despite the light price strength on Wednesday, the technical weakness in the charts after Tuesday’s session will keep sellers active as prices consolidated at the bottom of yesterday’s lows. The corn market is just lacking friendly news to push prices higher.

- South American weather looks to stay favorable for crops and is a limiting factor to grain prices. Some of the driest areas of Brazil saw beneficial rains over the weekend, and near-term forecasts keep the weather pattern more active.

- The impacts of recent weather and economic concerns have the market anticipating a reduced second corn crop this summer based on reduced acres. Some analysts feel the crop could be 10-12 mmt below last year.

- Favorable weather in Argentina is supporting the corn crop, which market analysts feel could double last year’s drought reduced production. Argentina corn is rated 38% good to excellent versus 15% last year. Harvest of these supplies will limit the potential for the corn market to rally in late spring into summer with competing bushels in the market.

Above: To start the year, March corn broke through 470 at the bottom end of the range that was held since the middle of November and is showing signs of being oversold, which can be supportive if prices turn higher. Currently, major support rests around 460 with the next major support area near 415. Above the market, resistance remains near the 50-day moving average and again between 495-500.

Soybeans

Action Plan: Soybeans

Calls

2023

No New Action

2024

No New Action

2025

No New Action

Cash

2023

No New Action

2024

No New Action

2025

No New Action

Puts

2023

No New Action

2024

No New Action

2025

No New Action

Soybeans Action Plan Summary

- No new action is recommended for 2023 soybeans. Front month soybeans recent downside breakout of the 1290 – 1400 range indicates the risk that prices may continue to retreat toward 1180, as forecasts for improved South American weather lessen the potential for the record large global carryout to be reduced. Given the potential of a downside breakout, Grain Market Insider recently recommended adding to sales as the current price level is still historically good. It’s been disappointing how the market has been unable to push higher despite the South American production concerns. Because of that, Grain Market Insider’s concern is that, if the weather pattern doesn’t remain adverse, the path of least resistance could be lower. Grain Market Insider will continue to look at additional sales opportunities, as well as potential re-ownership strategies.

- No new action is recommended for the 2024 crop. The Nov ’24 contract recently broke through the downside of the 1233 – 1320 range that has been in place since the end of July. With this downside breakout and considering the bullish influence of adverse South American weather which appears to be improving, Nov ’24 runs the risk of retreating towards 1150 unless another bullish catalyst enters the market. If prices find support and turn back higher, Grain Market Insider recently recommended buying Nov ’24 1280 and 1360 calls to give you confidence to make sales against anticipated 2024 production and to protect any sales in an extended rally. Grain Market Insider will also continue to watch for any sales opportunities.

- No Action is currently recommended for 2025 Soybeans. Grain Market Insider isn’t considering any recommendations at this time for the 2025 crop that will be planted two springs from now, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

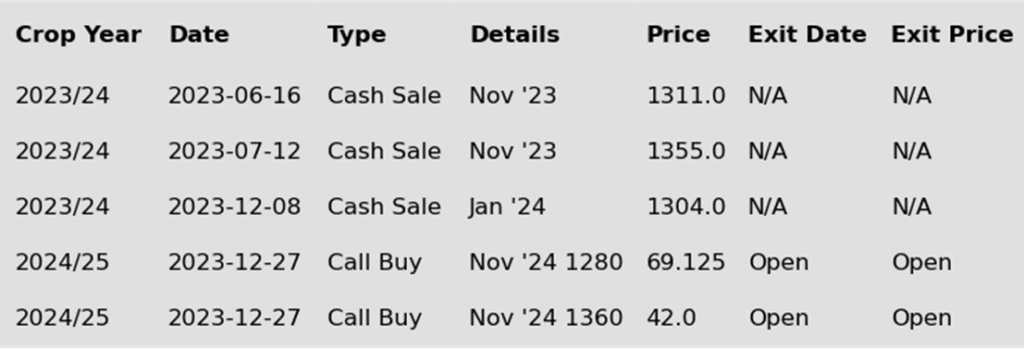

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

- Soybeans began the day lower but recovered later in the day with only the January contract (which is in deliveries) ending lower. Both soybean meal and oil ended the day higher with soybean oil getting support from higher crude oil.

- While yesterday’s selloff can likely be attributed to heavy rains over northern and central Brazil last weekend and an improved forecast, trade may now be focused on the upcoming WASDE report next Friday, which could feature cuts in South American production as well as a reduction in US ending stocks.

- The USDA’s most recent estimate for Brazilian soybean production was 161 mmt, which now seems very high as many analysts are projecting a number between 150 and 155 mmt. At the same time, Argentina is expected to produce at least double the amount of soybeans from last year which would offset the loss in Brazil and then some.

- The soybean harvest has already begun in Mato Grosso, Brazil, which is the primary growing state in the country. So far, the crops have been called very poor in certain areas, but yields have ranged from 27 to 49 bpa. It is worth noting that these soybeans are being harvested early due to the poor conditions and so second crop corn can be planted in a timely fashion.

Above: March soybeans opened the year with breaking through 1292 support, leaving a gap on the daily chart between 1290 ¾ and 1296 ¾ that the market may try to fill. If prices turn back higher to fill the gap, resistance may come in near the 50 and 100-day moving averages, while support rests below the market around 1250.

Wheat

Market Notes: Wheat

- Wheat traded lower again today with losses across the board in all three US classes. This is despite new Russian attacks on the port of Odesa in Ukraine on Tuesday and an arctic storm that will bring very cold temperatures to wheat growing areas of both countries.

- Adding to pressure in the wheat market is the continued recovery of the US Dollar Index which is higher again today. It may have currently run into some resistance around the 21-day moving average of 102.63, but if the uptrend continues it is sure to keep pressure on US exports. Additionally, Russian wheat FOB values are said to be around $245 per mt, keeping them the main global exporter.

- To point to a silver lining, though March Chicago wheat broke below the six dollar level today, it did close above that important psychological support level. But to be realistic, it may be difficult for wheat to rally significantly without the support of corn or soybeans. And with more rain in the forecast for the drier areas of Brazil, this could keep a lid on the grain complex as a whole.

- Winter wheat conditions in select states are improving. As of December 31, Kansas’ good to excellent rating came in at 43%, versus 39% for the week ending December 10. During a similar time period, conditions in Oklahoma were at 67% G/E versus 53%, and Texas was at 49% G/E versus 46%.

- Despite a larger planted wheat area for 2023 in Brazil, production was lower due to weather issues. According to CONAB, Brazilian wheat production may reach 8.14 mmt in 23/24, down 22.8% compared to the record of 10.55 mmt. However, this would still be the second biggest crop on the books.

Action Plan: Chicago Wheat

Calls

2023

No New Action

2024

No New Action

2025

No New Action

Cash

2023

No New Action

2024

No New Action

2025

No New Action

Puts

2023

No New Action

2024

No New Action

2025

No New Action

Chicago Wheat Action Plan Summary

- No new action is currently recommended for 2023 Chicago wheat. Between late July and the end of November, front month Chicago wheat trended lower, driven mostly by weak US demand and lower world wheat prices. During that time, and as managed funds established most of their short position of nearly 120,000 contracts, the market became extremely oversold. Since then, as the market rallied to a high of 649 ½, China made several US SRW wheat purchases, and funds covered more than 23,000 short contracts. During that runup, Grain Market Insider recommended making an additional sale to take advantage of the elevated prices in case the rally was temporary since US wheat prices remain elevated relative to other world exporters, despite the increase in demand. If the market remains strong and continues to rally, Grain Market Insider will consider potential re-ownership strategies to protect current sales and add confidence to make additional sales at higher prices.

- No new action is recommended for 2024 Chicago wheat. From the end of July, the July ’24 contract has slowly stepped its way down to a low of 586 in sympathy with the front month contract where managed money established a large short position during that time. Since then, July ’24 rallied alongside the March ’24 contract, as the funds covered over 30k contracts of their nearly 130k short contract position. While bearish headwinds remain, the funds continue to carry a large short position and seasonals remain supportive for the addition of weather risk premium, which are two factors that could fuel further short covering and another leg up in prices. At the end of August, Grain Market Insider recommended purchasing July 590 puts to prepare for further price erosion. Back in June, Grain Market Insider recommended two separate sales that averaged about 720 to take advantage of the brief upswing. If the market receives the needed stimulus to move prices back toward this summer’s highs, Grain Market Insider is prepared to recommend adding to current sales levels and possibly even purchasing call options to protect those sales. Otherwise, the current recommended put position will add a layer of protection if prices erode further, and Grain Market Insider will be prepared to recommend covering some of those puts to offset much of the original cost and move toward a net neutral cost for the remaining position.

- No action is currently recommended for 2025 Chicago Wheat. Grain Market Insider isn’t considering any recommendations at this time for the 2025 crop that will be planted next fall. It will probably be mid-winter before Grain Market Insider starts considering the first sales targets.

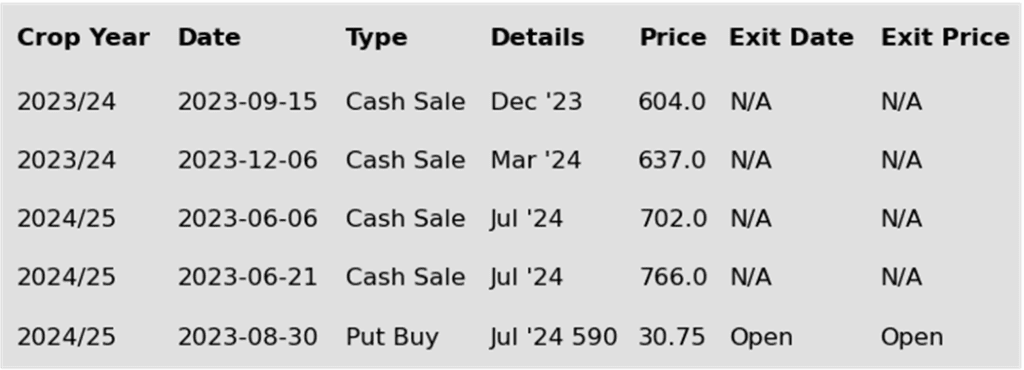

To date, Grain Market Insider has issued the following Chicago wheat recommendations:

Above: March Chicago wheat is challenging support near 600, and the 50 and 100-day moving averages. If support holds, resistance overhead remains near 650. If not and the market breaks further, the next level of major support comes in near 556.

Action Plan: KC Wheat

Calls

2023

No New Action

2024

No New Action

2025

No New Action

Cash

2023

No New Action

2024

No New Action

2025

No New Action

Puts

2023

No New Action

2024

No New Action

2025

No New Action

KC Wheat Action Plan Summary

- No new action is recommended for 2023 KC wheat crop. Since late July old crop KC wheat has been in a downtrend that has largely been driven by managed fund selling on low world wheat prices and weak US export demand. As the selloff progressed, the market became oversold, and the funds established the largest short position in three years. Even though bullish headwinds remain, these two factors have fueled the recent short-covering rally, which could extend much further if a bullish catalyst enters the market. This would also line up with the historical tendency for price appreciation as the market builds risk premium going into wintertime. Grain Market Insider’s strategy is to look for price appreciation going into this winter, as weather becomes a more prominent market mover and may consider suggesting additional sales if prices become over extended.

- No new action is recommended for 2024 KC wheat. At the end of August, the July ’24 contract broke out of roughly a one-year trading range and stepped down to a 609 ¼ low in late November, largely driven by managed fund selling in the front month on weak US export demand and lower world wheat prices. Since then, the funds covered part of their large short position which also rallied prices in the July ’24 contract. While bearish headwinds remain, managed funds continue to hold a sizable, short position, and price seasonals remain positive for adding weather risk premium. These are two factors that could fuel additional short covering and rally prices in the months ahead. Back in August, Grain Market Insider recommended buying Jul’24 KC wheat 660 puts to protect the downside following the range breakout. As the market recently got further extended into oversold territory and the July contract showed signs of support near 630, Grain Market Insider recommended exiting 75% of the originally recommended position. Moving forward, Grain Market Insider is prepared to recommend exiting the last 25% on any further supportive market developments.

- No action is currently recommended for 2025 KC Wheat. Grain Market Insider isn’t considering any recommendations at this time for the 2025 crop that will be planted next fall. It will probably be mid-winter before Insider starts considering the first sales targets.

To date, Grain Market Insider has issued the following KC recommendations:

Above: March KC wheat rejected an attempt to move higher near 650 and turned lower to test the bottom end of the recent range around 619. If the market continues to retreat, the next area of support remains near 595 and 575. Overhead, nearby resistance comes in around 650 and again between 675 – 680.

Action Plan: Mpls Wheat

Calls

2023

No New Action

2024

No New Action

2025

No New Action

Cash

2023

No New Action

2024

No New Action

2025

No New Action

Puts

2023

No New Action

2024

No New Action

2025

No New Action

Mpls Wheat Action Plan Summary

- No new action is currently recommended for the 2023 New Crop. Following last July’s rally, the market has slowly stair-stepped lower, primarily due to low world wheat prices, weak US export demand, and managed fund selling. With the funds building a record large short position as the market sold off. Since weak US export demand remains the main impediment to higher prices, the market continues to be at risk of further downside erosion. The record large fund short position could fuel a rally back higher if a bullish catalyst enters the scene, and if that happens, it may signal that a near-term low is in place. Earlier this year, Grain Market Insider made a sales recommendation during the July rally near 820, and with that sale in place, Grain Market Insider’s strategy is to look for price appreciation this winter with an eye on considering additional sales around 725 – 775, and again north of 800. If at that point the market remains strong and continues to rally, Grain Market Insider will consider potential re-ownership strategies to protect current sales and add confidence to make additional sales at higher prices.

- No new action is recommended for 2024 Minneapolis wheat. At the end of August, the Sept ’24 contract traded to a peak of 871 ¾ and has continued to slowly stair-step lower, largely driven by lower world wheat prices, weak US export demand, and managed fund selling, and as the selloff progressed, the funds built up a record large short position. While bearish headwinds remain, the significant oversold condition of the market and the large fund net short position are two factors that could fuel a short-covering rally in the months ahead. Price seasonals are also supportive as prices tend to build in some risk premium going into the winter months. Back in August, Grain Market Insider recommended buying July ’24 KC wheat 660 puts to protect the downside following a 1-year range breakout in KC wheat. Though recently, as the KC market extended further into oversold territory and the July ‘24 KC wheat contract showed signs of support near 630, Grain Market Insider recommended exiting 75% of the originally recommended position. While in the same time frame, Grain Market Insider also recommended making an additional sale as the Sept ’24 Minneapolis contract broke long time 743 support. For now, moving forward, Grain Market Insider is prepared to recommend exiting the last 25% of the open puts on any further supportive market developments.

- No action is currently recommended for the 2025 Minneapolis wheat crop. Grain Market Insider isn’t considering any recommendations at this time for the 2025 crop that will be planted two springs from now. It will probably be mid-winter before Grain Market Insider starts considering the first sales targets.

To date, Grain Market Insider has issued the following Minneapolis wheat recommendations:

Above: After making a new contract low on November 27, the March contract found buying interest from its oversold status and record fund short. Since then, the market posted a bearish reversal on December 6, showing significant resistance in the 750 area. If prices can break through upside resistance, they could run toward 790. If prices retreat, nearby support could be found around 718, with further support near the recent low of 697 ½.

Other Charts / Weather